The world of finance is experiencing a technological revolution. From traditional banking to innovative fintech startups, companies are discovering how AI in finance can transform their operations, improve customer experiences, and create competitive advantages.

Even Niall Byrne, CFO at Qatar Investment Authority (QIA) said "AI has huge potential for finance functions, but to be meaningful, it requires significant investment in data readiness and balanced cybersecurity posture. At QIA, we are exploring pilot projects with clear metrics to help quantify the ROI on AI investments." Source:- Here

This comprehensive guide explores everything you need to know about artificial intelligence in financial services and how modern finance app development is shaping the future of money management.

Whether you're a business leader evaluating AI opportunities or someone curious about how financial AI is changing the industry, this guide provides practical insights into the applications, benefits, and implementation strategies driving success in today's financial landscape

What is AI in Finance?

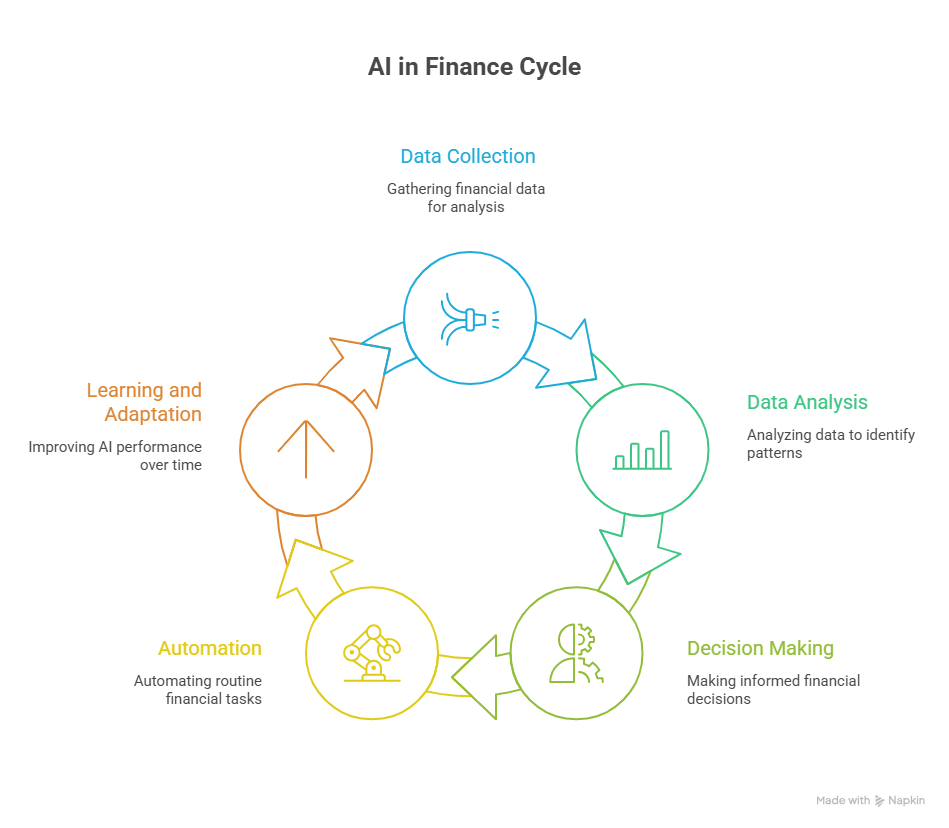

AI in finance refers to the use of artificial intelligence technologies to automate processes, analyze data, and make intelligent decisions in financial services. Simply put, AI is smart technology that learns from data and makes decisions without constant human intervention.

Unlike traditional software that follows pre-programmed rules, finance AI systems can adapt, learn, and improve their performance over time. The key technologies powering AI in finance include machine learning, natural language processing, and predictive analytics.

The financial services industry has undergone a remarkable transformation over the past few decades. We've moved from manual processes and paper-based transactions to digital banking and mobile-first experiences. The rise of fintech companies has accelerated this evolution, introducing innovative finance app solutions that challenge traditional banking models.

Today, AI in finance represents the next major transformation. According to McKinsey's latest Global Survey on AI, 78% of organizations now use AI in at least one business function, up from 55% a year earlier.

finance fundamentally transforms this approach. Instead of fixed rules, AI systems learn from data patterns. Rather than manual processing, finance AI automates routine tasks while handling complex analyses.

AI application in finance enables companies to anticipate customer needs, prevent problems before they occur, and deliver personalized experiences that foster stronger customer relationships.

Why Finance Companies Needs AI Today?

Financial services companies face unprecedented pressures that make AI in finance adoption essential. Customer expectations have evolved dramatically people now expect instant responses, personalized recommendations, and seamless experiences across all touchpoints.

Competition from tech-savvy startups has intensified these pressures. New fintech companies built with AI-first approaches are capturing market share by offering superior user experiences and innovative services.

Today's financial services customers have fundamentally different expectations. Mobile-first preferences mean customers expect full finance app functionality on their smartphones.

They want 24/7 service availability and personalized financial advice as standard features.Finance AI enables round-the-clock service through intelligent chatbots and automated systems that can handle complex inquiries at any time.

AI in finance addresses several critical business challenges. High operational costs from manual processes consume significant resources and limit scalability. Slow decision-making in lending and investment processes frustrates customers and creates competitive disadvantages. As of today, the AI adoption in financial services is growing, and it's estimated at $97 billion by 2027, and on top of that, over 85% financial firms are actively applying AI in many areas.

Fraud losses and security concerns represent ongoing threats that traditional systems struggle to address effectively. Finance AI makes mass personalization practical and profitable at scale.

Make Your Finance App Actually Intelligent

Stop building yesterday's solutions for tomorrow's customers. Discover how AI transforms financial services from reactive to remarkable.

How AI Helps Different Types of Finance Companies

1. Loan Processing

AI in finance transforms traditional banking operations across multiple areas. Loan processing automation accelerates approval decisions from weeks to minutes while maintaining decision accuracy. Finance AI systems analyze applicant data, credit history, and alternative data sources faster than human underwriters.

2. Fraud Detection

Fraud detection systems represent one of the most successful applications. These systems monitor transaction patterns in real-time, identifying suspicious activities that traditional systems miss.

JPMorgan Chase demonstrates the transformative power of AI in finance through comprehensive implementations that saved $1.5 billion through fraud detection and operational efficiency improvements.

JPMorgan Chase demonstrates the transformative power of AI in finance through comprehensive implementations that saved $1.5 billion through fraud detection and operational efficiency improvements.

Their AI systems process thousands of transactions per second, identifying fraudulent patterns that traditional systems miss while reducing false positives that inconvenience customers.

Customer service chatbots powered by finance AI handle routine inquiries 24/7, from balance checks to transaction explanations.

Bank of America's Erica chatbot represents a successful AI application in finance for customer service, handling over 2.5 billion customer interactions.

Bank of America's Erica chatbot represents a successful AI application in finance for customer service, handling over 2.5 billion customer interactions.

The chatbot can answer account questions, help with transactions, provide financial guidance, and escalate complex issues to human agents when necessary.

Investment & Wealth Management Firms

3. Portolio Management

Finance AI changing investment management through sophisticated market analysis and research capabilities.

Portfolio management benefits significantly from AI application in finance through automated rebalancing and performance optimization.

BlackRock's Aladdin platform showcases sophisticated AI in finance for portfolio risk management across trillions of dollars in assets.

Portfolio management benefits significantly from AI application in finance through automated rebalancing and performance optimization.

BlackRock's Aladdin platform showcases sophisticated AI in finance for portfolio risk management across trillions of dollars in assets.

The system provides real-time risk analytics, automated rebalancing recommendations, and comprehensive portfolio monitoring for investment managers globally.

4. Personalized Investment Recommendations

Client advisory services leverage finance AI to provide personalized investment recommendations based on individual risk profiles and financial goals.

Research automation accelerates the generation of investment research reports and market analysis.

Goldman Sachs employs automated trading algorithms that represent advanced AI application in finance for market opportunity detection.

Research automation accelerates the generation of investment research reports and market analysis.

Goldman Sachs employs automated trading algorithms that represent advanced AI application in finance for market opportunity detection.

These systems analyze market patterns, news sentiment, and trading volumes to identify profitable opportunities and execute trades faster than human traders.

Lending & Credit Companies

5. Credit Scoring

Alternative credit scoring represents a transformative application of AI in finance for lending companies.

Finance AI systems analyze alternative data like bank account activity and digital behavior to assess credit risk more comprehensively.

LendingClub uses alternative credit scoring through AI in finance to expand access to credit.

Finance AI systems analyze alternative data like bank account activity and digital behavior to assess credit risk more comprehensively.

LendingClub uses alternative credit scoring through AI in finance to expand access to credit.

Their systems analyze non-traditional data sources like bank account activity and digital behavior to assess creditworthiness for applicants who might be rejected by traditional credit scoring methods.

6. Application Processing Automation

Application processing automation streamlines the lending workflow from application to approval in minutes rather than days.

Collection optimization through AI in finance improves recovery rates while maintaining customer relationships.

Kabbage, now part of American Express, automated small business lending decisions using AI application in finance.

Collection optimization through AI in finance improves recovery rates while maintaining customer relationships.

Kabbage, now part of American Express, automated small business lending decisions using AI application in finance.

Their systems could analyze business bank account data and provide lending decisions in minutes rather than the weeks required by traditional lenders.

Insurance Companies

7. Claims Processing Automation

Claims processing automation represents a major opportunity for AI applications in finance within insurance. AI systems can assess property damage through photographs and approve straightforward claims automatically.

Lemonade uses AI in finance for claims processing and customer service through AI chatbots that can handle simple claims in seconds.

Their system can assess property damage through photographs and approve or deny straightforward claims automatically.

8. Risk Evaluation

Risk evaluation and pricing benefit from finance AI through more sophisticated risk assessment models. Fraud detection in insurance relies on AI in finance to identify suspicious claims patterns.

Payment & Fintech Startups

9. Transaction Monitoring

Transaction monitoring represents a critical application of AI in finance for payment companies. Smart financial guidance through finance AI helps users make better financial decisions by analyzing spending patterns and fiancial goals.

Few more Examples

- Root Insurance demonstrates usage-based auto insurance through mobile AI technology. Their AI application in finance analyzes driving behavior through smartphone sensors to provide personalized insurance rates based on actual driving patterns rather than demographic assumptions.

- Metromile offers pay-per-mile insurance powered by AI analytics. Their finance AI systems track actual vehicle usage to provide fair, usage-based pricing that benefits low-mileage drivers while maintaining profitability for the insurance company.

- Upstart employs AI-driven personal loan underwriting that considers over 1,000 variables to assess creditworthiness. This finance AI approach results in higher approval rates and lower default rates compared to traditional underwriting methods.

- Robo-advisors like Betterment and Wealthfront demonstrate how finance AI makes professional investment advice accessible to broader audiences. These platforms use AI algorithms to create and manage diversified portfolios based on individual risk tolerance and financial goals.

Other Functions AI Could Change the Finance Operations

Automation Functions

AI in finance automation changes routine operations by eliminating manual data entry and verification processes. Document processing systems extract information from forms and applications automatically, reducing processing time and eliminating human errors.

Transaction processing automation handles routine financial operations without human intervention. Report generation creates real-time business insights from operational data automatically.

The bueiness impact includes significant efficiency gains as staff can focus on high-value activites instead of routine tasks. Cost reduction comes from lower operational expenses, while 24/7 operations become possible.

Analysis & Intelligence Functions

Data pattern recognition represents a core capability of finance AI that identifies trends in market and customer data. Risk modeling through AI applications in finance creates more sophisticated and accurate risk assessments.

Performance analytics measure and optimize business metrics across all operations. Customer behavior analysis uses AI in finance to understand user preferences at an individual level.

The business impact includes better decision-making through data-driven strategic choices and competitive advantages from market insights that competitors lack.

Personalization Functions

Customer segmentation through an AI application in finance groups users by behavior and preferences. Product recommendations powered by finance AI suggest relevant financial services based on individual customer profiles.

User interface adaptation uses AI in finance to customize app experiences for individual users. Communication timing optimization determines when to engage customers for maximum effectiveness.

The business impact includes improved customer satisfaction and revenue increases from higher conversion rates on recommendations.

Security & Protection Functions

Identity verification through finance AI confirms user authenticity using multiple factors, including biometric data and behavioral patterns. Transaction monitoring represents a critical application for detecting suspicious activities in real-time.

Cybersecurity protection uses AI applications in finance to defend against digital threats and attacks. Data privacy protection ensures compliance with privacy regulations while enabling necessary business functions.

The business impact includes trust building as customers feel safe and protected, plus loss prevention that reduces fraud and security breach costs.

Prediction & Forecasting Functions

Market forecasting through an AI application in finance predicts market trends based on historical data and current conditions. Cash flow prediction uses finance AI to anticipate liquidity needs and optimize financial planning.

Customer lifetime value estimation helps prioritize customer acquisition and retention efforts. Default probability assessment evaluates credit risk more accurately than traditional methods.

The business impact includes improved strategic planning and more efficient resource allocation.

Communication & Support Functions

Natural language processing enables AI in finance systems to understand and respond to customer queries in conversational language. Multi-language support serves diverse, global customer bases without requiring human translators.

Voice recognition enables hands-free banking interactions. Sentiment analysis monitors customer satisfaction levels by analyzing communication tone and content.

The business impact includes improved customer experience and global reach for serving international markets.

Your Competitors Are Already Using AI. Are You?

While you're thinking about AI integration, they're already delivering personalized experiences that keep customers coming back.

How Flutter Enables AI-Powered Finance Apps

Now, Why we are talking aobut Flutter? The way people interact with financial services has fundamentally changed. Just a decade ago, customers visited physical bank branches for most transactions and used desktop computer for online banking.

Today's consumers expect to manage their entire financial lives through finance app solutions on their smartphones. This shift has made mobile applications critical for every financial institution, as customers want to check balances, apply for loans, invest in stocks, and access AI in finance features all from their phones.

Traditional mobile development requires separate teams building different versions for iPhone and Android, which becomes expensive and time-consuming when adding complex finance AI capabilities.

This challenge has made Flutter essential for modern AI application in finance development, enabling companies to create sophisticated mobile applications that work perfectly across all platforms while integrating intelligent features that today's customers demand.

Why Flutter for AI Finance Applications

Flutter AI development offers unique advantages for creating intelligent financial applications. The framework's cross-platform efficiency means one codebase works seamlessly across iOS, Android, and web platforms, reducing development time and costs significantly.

Flutter mobile developer teams can integrate AI capabilities more easily thanks to Flutter's native support for machine learning frameworks. Performance optimization in Flutter AI applications ensures that AI-powered features remain fast and responsive.

Cost-effective development represents a major advantage when dedicated Flutter development teams build AI-powered financial applications.

Technical Advantages for AI Integration

TensorFlow Lite support in Flutter AI enables sophisticated on-device AI processing capabilities. Cloud AI services integration allows flutter mobile developer teams to easily connect with powerful AI platforms like Google AI and AWS SageMaker.

Real-time data processing capabilities efficiently handle financial data streams and transaction monitoring. Security features built into Flutter provide essential protection for finance app development.

Flutter's Role in AI Finance App Development

Rapid prototyping capabilities enable dedicated flutter development teams to quickly test AI features and concepts. Scalable architecture ensures that Flutter AI applications grow with business requirements.

Consistent user experience across platforms means flutter mobile developer teams can ensure unified AI interactions across all devices. Developer productivity improvements result from Flutter's comprehensive development tools.

Business Benefits for Finance Companies

Faster time-to-market enables companies to launch AI features quickly across all platforms simultaneously. Lower development costs result from needing only a single flutter mobile developer team instead of separate platform teams.

Easier maintenance means companies can update AI models through a single codebase. Future-ready platform capabilities ensure that Flutter AI applications can easily incorporate new AI technologies as they become available.

Getting Started with AI in Your Finance Business

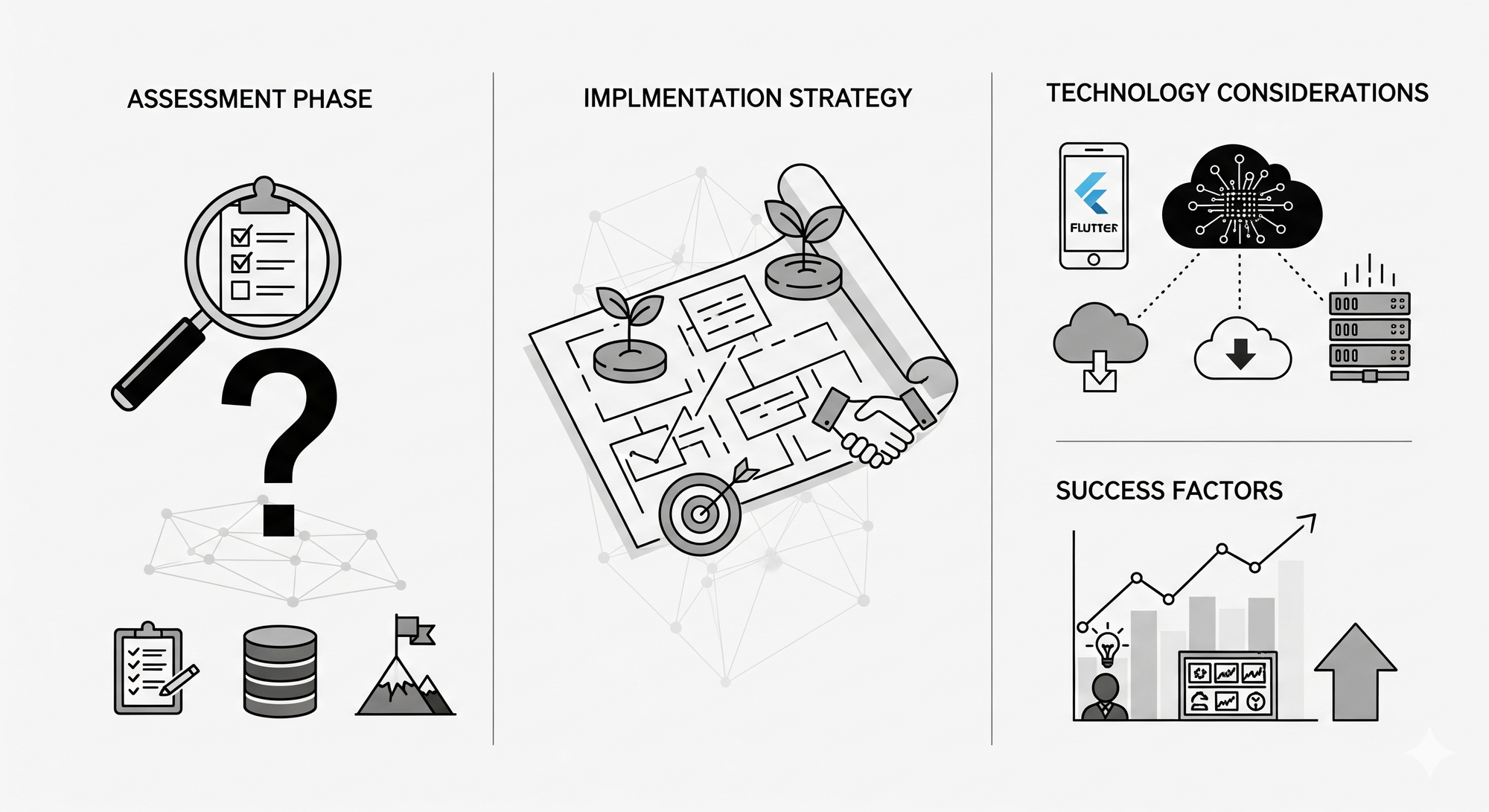

Assessment Phase

The first step in implementing AI in finance involves identifying pain points where manual processes slow operations. Evaluating data readiness represents a crucial step in AI application in finance planning.

Defining success metrics helps measure the impact of finance AI implementations. Budget planning requires understanding the investment requirements and timeline.

Implementation Strategy

Starting small with finance AI implementation reduces risk and builds organizational confidence. Choosing high-impact areas ensures visible benefits that justify continued investment.

Partner selection becomes crucial for successful AI in finance implementation. Phased rollout enables gradual deployment with user feedback integration.

Technology Considerations

Platform selection affects long-term success and costs. Flutter provides excellent capabilities for cross-platform finance app development with AI integration.

AI service integration decisions involve choosing between cloud-based and on-device processing. Data infrastructure requirements include secure, scalable data management systems.

Success Factors

User training ensures both staff and customers understand new AI features. Continuous monitoring tracks performance and identifies optimization opportunities.

Iterative improvement helps finance AI systems evolve over time. Long-term vision development creates a roadmap for expanding AI application in finance capabilities.

Turn AI Curiosity Into Competitive Advantage

You know AI matters for finance apps. Now let's build yours. Our Flutter + AI experts make intelligent financial apps reality.

Conclusion

AI in finance has moved beyond experimental phases to become essential for competitive financial services companies. Early adopters are gaining sustainable advantages in customer service and operational efficiency.

Financial institutions that implement AI application in finance thoughtfully are building stronger customer relationships through personalized experiences and superior service.

The question isn't whether finance AI will transform your business it's whether you'll lead that transformation or be forced to follow. If you are looking to develop a quick mobile or web app for your business we can help you build within few weeks! Contact us today!

FAQs

What is AI in finance, and how does it work?

AI in finance refers to artificial intelligence systems that automate processes, analyze data, and make intelligent decisions in financial services. Finance AI works by processing large amounts of financial data to identify patterns, make predictions, and automate routine tasks.

Which AI functions provide the best ROI for finance companies?

The highest ROI applications of AI in finance typically include fraud detection systems, customer service chatbots, and automated underwriting. AI applications in finance for personalization and risk assessment also deliver strong returns.

How can small finance companies afford AI implementation?

Small companies can start with cloud-based finance AI services that require minimal upfront investment. Starting with simple applications like chatbots allows for gradual expansion as benefits are realized..

Is AI in finance secure and compliant with regulations?

AI in finance systems can be highly secure and compliant when properly implemented. Modern AI platforms include built-in security features and audit trails required for financial service

How long does it take to implement AI in financial services?

Implementation timelines for AI applications in finance vary based on complexity. Simple applications can be deployed in 2-3 weeks, while comprehensive systems may require 1-3 months.

Why is Flutter recommended for AI-powered finance apps?

Flutter enables efficient development of AI-powered finance app solutions across multiple platforms with a single codebase. The framework's native AI integration capabilities make it ideal for implementing AI in finance solutions quickly and efficiently.