Low-code platforms have been transforming Fintech development for the good. However, with more than 500 low-code platforms available and Gartner predicting that 70% of apps in the current year will be developed using low-code/no-code platforms, it becomes crucial for a Fintech leader to make the decision astutely.

The wrong selection can potentially have an adverse effect on the scalability aspect and speed of your Fintech apps. Also, do not forget about the compliance and UX factors that can impact the app.

So, while comparing FlutterFlow vs Mendix for Fintech, you need to take a wise call by asking this question: Which of these two low-code platforms is the best balanced for providing security, flexibility, and app performance?

In this FlutterFlow Mendix comparison, we break down the features and capabilities of financial apps, which will assist you in determining the best low-code Fintech platform for your project.

Irrespective of whether you require the swiftness and visual development for customer-facing apps of FlutterFlow or the enterprise-grade backend strength of Mendix, we will deep dive into which low-code Fintech development platform aligns with your business objectives.

What is FlutterFlow?

FlutterFlow is a low-code/no-code visual app builder that can create cross-platform mobile and web apps without technical code. You can think of it as Wix for Fintech applications. However, it has serious power under the hood. It has been developed using the Flutter framework of Google.

Its strength lies in the lethal combination of drag-and-drop simplicity with the prowess to customize every pixel. This makes it perfect for Fintech startups and enterprises that require swift, visually attractive, and fully functional applications.

Reasons Fintech Teams Love It

- Speed - You can launch MVPs weeks quicker than traditional development.

- Flexibility- Compared to rigid templates, it gives you total control over animations, branding, and UX flow.

- Firebase Integration - It helps in effective management of user authentication, real-time data like stock prices, and elementary cloud functions without requiring any expertise in backend.

- Fintech-Ready - It comprises plugins for Stripe, Plaid, and Twilio so that you can integrate payments, KYC, or SMS alerts swiftly.

Effectiveness of FlutterFlow Framework in Fintech Applications

- Neobanks and Digital wallets, especially customer-facing UIs.

- Trading and Investment Applications with real-time data visualization.

- Loan and Insurance Portals with quick revisions on compliance workflows.

Although FlutterFlow saves months of development time, complex Fintech logic like risk engines may still require custom code. This is where partnering with a FlutterFlow Fintech specialist like Third Rock Techkno pays rich dividends, as top FlutterFlow agencies bridge the gap between low-code speed and enterprise requirements.

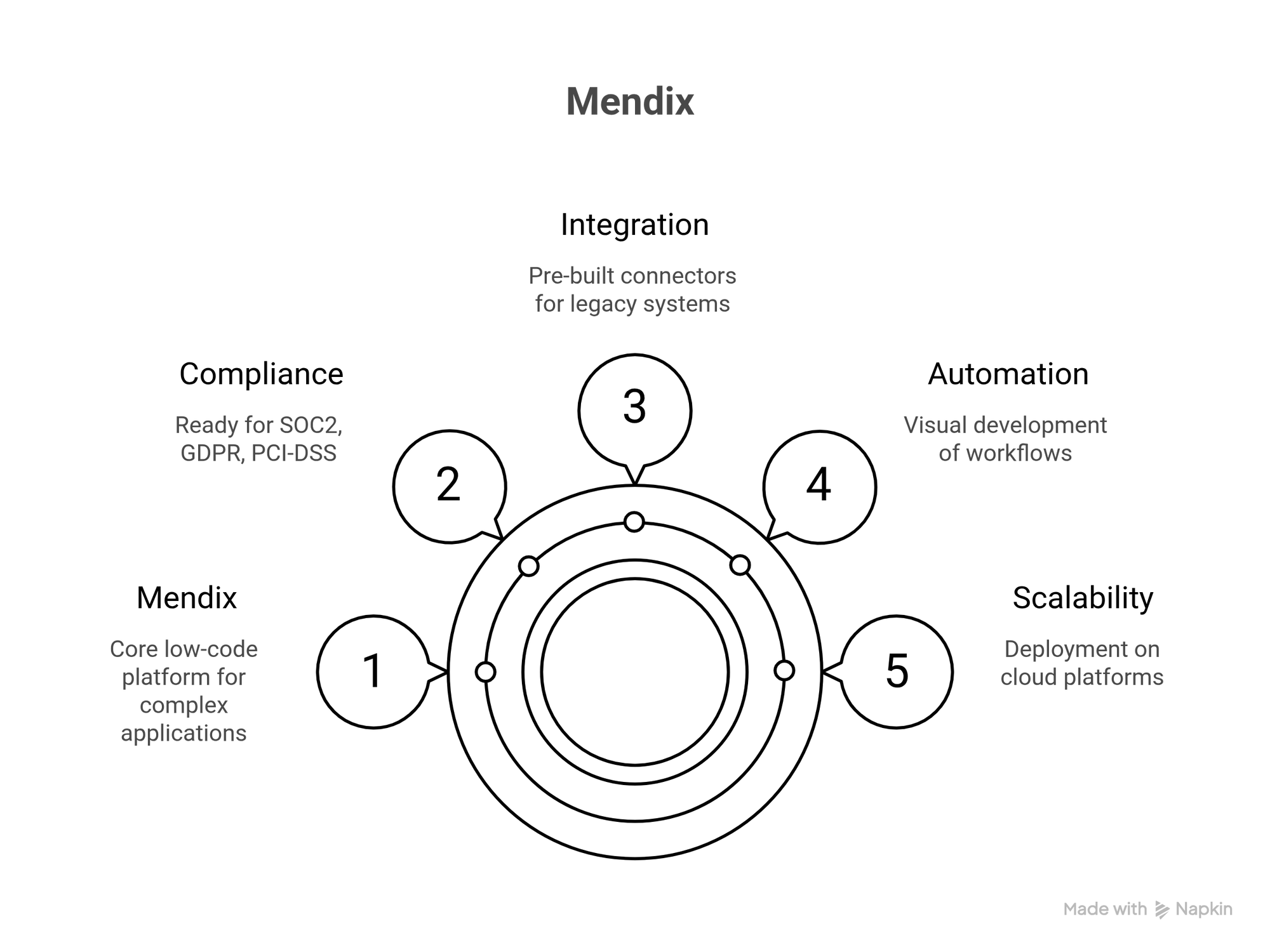

What is Mendix?

Mendix is an enterprise-level low-code platform that assists in developing complex and scalable applications. It is ideal for insurers, bankers, and Fintech that need rock-solid security and heavy integrations.

Compared directly with FlutterFlow, Mendix acts like a visual programming language that enables business teams and developers to collaborate on apps that manage everything from core banking systems to regulatory compliance workflows.

Reasons Enterprises Trust This Platform

- Compliance Out of the Box - It is ready for SOC2, GDPR, and PCI-DSS, which is crucial for regulated finance.

- Legacy System Integration - It consists of pre-built connectors for IBM, SAP, and core banking platforms without any custom coding requirement.

- Workflow Automation - You can visually develop loan approvals, fraud detection, or KYC pipelines without any code.

- Scalability - It deploys on private cloud or AWS and Azure, thereby managing millions of transactions in a secure manner.

Types of Fintech Applications That Can Be Developed Using This Platform

- Core Banking Modernization requires upgrading old systems without rebuilding from scratch.

- Insurance Underwriting Platforms that require complex rule-based workflows.

- Compliance Tools need data masking and audit trails.

Mendix is an overkill for simplistic Fintech MVPs, as its power comes with a steeper learning curve and higher cost. However, if you are developing the central nervous system of finance and not merely the customer interface, it is unparalleled.

The Right Low-Code Choice Can Make or Break Your Fintech App

Compare FlutterFlow vs Mendix across compliance, scalability, and UX so you don’t choose wrong.

Features and Capabilities Comparison of FlutterFlow and Mendix for Financial Apps

While opting between FlutterFlow and Mendix for low-code Fintech development, remember that the right choice of platform can be dependent upon the core requirements of the project.

Here is a breakdown of how these two frameworks stack up in critical areas of financial applications.

1. UI/UX Development and Frontend Flexibility

The FlutterFlow framework is ideally suited for customer-facing applications like neobanks and trading platforms. While using this framework, you end up getting pixel-perfect UI control and rapid prototyping. And do not forget about the Flutter-based animations. Its limitation is that this framework is less suited for data-heavy admin dashboards.

On the other hand, Mendix is best suited for internal banking tools like compliance portals and loan processing. When you opt for this platform, you can avail of standardized templates for enterprise workflows. However, the biggest limitation of this platform is that its UI feels out-of-the-box, which makes it tougher to align with Fintech UX leaders.

If you wish to create branded mobile-first experiences, go for FlutterFlow. But if you give utmost preference to functionality over flashy design, opt for Mendix.

2. Backend Logic and Workflow Automation

FlutterFlow depends on Firebase or custom backends, which makes it ideal for elementary transactions; however, you will have to put in extra work for complex logic. On the other hand, Mendix consists of visual workflow builders that automate multi-step processes like fraud detection and KYC approvals without writing technical code.

If you wish to opt for low-code Fintech development that requires heavy backend logic, Mendix is way ahead of FlutterFlow.

3. Security and Compliance

FlutterFlow needs manual setup for PCI-DSS and GDPR compliance checks, which makes it a perfect fit for low or mid-risk applications like budgeting tools. On the other hand, Mendix comes with enterprise-ready compliances like SOC2 and audit trails. It also comes with built-in granular controls, which are critical for core banking.

When it comes to FlutterFlow vs Mendix for Fintech compliance requirements, regulated Fintechs are slightly in favor of Mendix.

4. Integration with Banking and Financial Systems

FlutterFlow enables plug-and-play integration, which can be utilized with contemporary APIs like Stripe and Plaid. Mendix integrates with legacy systems like SAP without any hassle.

If you wish to develop a crypto wallet, choose FlutterFlow. But if you are looking to modernize the core systems of a retail bank, choose Mendix.

5. Scalability and Performance

FlutterFlow scales well for frontend-heavy applications that have more than 50k users. However, its backend is totally dependent on Firebase or custom code. At the same time, Mendix manages millions of transactions on the cloud or on-premise, which makes it a proven platform for large banks.

For the best low-code Fintech platform scalability, Mendix has an upper hand over FlutterFlow.

6. Developer and Team Collaboration

FlutterFlow has a low learning curve, which makes it perfect for designers and business teams that wish to collaborate effortlessly. In contrast, Mendix comprises a role-based development environment that allows IT and business teams to work together.

If you have a small team, the simplicity of FlutterFlow can help. If you are a large enterprise, the structure of Mandix averts chaos.

💡

FlutterFlow is equal to speed and UX, which makes it fit for customer applications and Fintech MVPs. In comparison, Mendix is equal to security and scale, which makes it ideal for regulated finance and core banking applications.

FlutterFlow vs. Mendix Pricing Comparison

Here is a look at the FlutterFlow Mendix comparison when it comes to pricing.

FlutterFlow

1. Free Plan

This is a seamless way for developers to familiarize themselves with the powerful platform's restricted features and app use.

For Fintech applications, this plan is not useful for production as it does not contain Firebase API calls.

2. Pro Plan

This is a paid plan for which you need to spend $30 per month. However, it provides most of the features that are adequate for individual developers and small teams. This plan is tailor-made for companies with basic project needs like one app, 50k Firebase API calls per month, and basic integrations like Stripe and Plaid.

For Fintech applications, Firebase costs spike with user growth. Hence, you must plan for extra authentication and a real-time data budget.

For the premium plan of FlutterFlow, you need to pay $60 on a monthly basis. In lieu of this, you end up getting team collaboration features and advanced functionalities, which are essential to carry out demanding projects. You can avail of team collaboration features, three Fintech applications, and 250k API calls here. The only caveat is that you need a distinct Firebase/GCP budget for scaling.

4. Pay-as-you-go model

When you opt for this pricing plan, you can extend your app usage beyond its limitations. However, you need to incur costs for every additional active user and installation on your app. This plan is ideal for high-volume Fintech applications like neo banks and trading platforms.

However, you must watch out for annual commitment and infrastructure costs while opting for this plan.

Mendix

1. Free Plan

This plan allows you to give this platform a try and explore the possibilities for building prototypes or small applications for personal use.

2. Standard Plan

The standard plan enables you to develop department-wide business applications. If you wish to develop a single app, the plan starts at €900/month. For unlimited applications, the plan starts at €2,100/month.

This plan is perfect for most business applications as it consists of all the key features for the application lifecycle, with deployment in the cloud of your choice.

This plan allows you to build complex, enterprise-level Fintech applications. Mandix provides Premium or Enterprise editions, often needing custom quotes based on specific requirements.

This plan may include more features, support, and customization options that can cater to the rigorous requirements of the Fintech industry.

Pros and Cons of Each Platform For Fintech Projects

Pros of FlutterFlow

1. Quick UI Development

When you compare FlutterFlow Mendix finance projects, FlutterFlow wins for customer-facing apps thanks to its drag-and-drop builder. It creates bank-grade UIs three times faster than Mendix's template-driven approach.

2. Quick MVP Scaling

You can launch a trading app or neobank MVP in weeks versus months using Mendix. This makes FlutterFlow for Fintech projects ideal for startups that wish to test their ideas before securing funds.

3. Thriving Third-Party Plugin Library

The pre-built FlutterFlow integrations of Stripe, Plaid, and Firebase cut down the development time for payments and KYC. This is a clear win-win situation when you compare FlutterFlow Mendix's finance capabilities.

4. Economical for Startups

FlutterFlow has lower upfront costs compared to Mendix for compliance features. This makes it perfect for bootstrapped Fintechs testing ideas.

5. Helps in Designing a Branded UX

When you directly compare the rigid Mendix templates, FlutterFlow gives you complete freedom to gain control over animations, layouts, and micro-interactions. This makes it vital for apps that are competing on UX.

Cons of FlutterFlow

1. Not Suitable for High-Frequency Trading or Core Banking Logic

If you wish to perform complex backend workflows like automated settlements and risk engines, there is an acute need for Firebase extensions or custom code that Mendix can manage visually.

2. Compliance is Not In-Built

You require manual setup for PCI-DSS and GDPR, which makes it less perfect for regulated Fintech like licensed Neobanks unless you integrate security layers.

3. Scalability is Dependent on Your Backend

When you scale your app, Firebase becomes exorbitant at a scale of more than 1M users, wherein you may be required to migrate to a custom backend at a later date.

4. Limited Legacy System Integration

FlutterFlow struggles with core banking mainframes like Temenos, FIS, or even IBM systems. In this case, Mendix's pre-built connectors win hands down.

5. Zero Built-in Workflow Automation

There are zero visual tools in FlutterFlow for loan approvals or fraud detection pipelines. You are required to code these or utilize third-party services, while Mendix includes them out of the box.

Pros of Mendix

1. Enterprise-Grade Security and Compliance

Out-of-the-box GDPR, PCI-DSS, and SOC2 save more than six months of audits for regulated Fintechs like insurers and neobanks. Unlike Flutterflow, there is no requirement to build security from scratch.

2. Powerful Backend and Workflow Automation

With drag-and-drop fraud detection, KYC pipelines, and loan approvals, Mendix is a clear winner because FlutterFlow requires custom coding.

3. Impeccable Legacy System Integration

Mendix consists of pre-built connectors for core banking systems like Temenos and FIS, which are vital for modernizing old infrastructure.

4. Scalability for Large Fintech Applications

Mendix can easily deploy on a private cloud or AWS, which helps in hassle-free management of high-frequency transactions compared to Firebase-dependent setups.

5. Collaboration Between Business and IT

It allows non-tech teams to design workflows while IT professionals can manage security, which reduces the scope for misalignment in large enterprises.

Cons of Mendix

1. Slower UI/UX Development

Mendix is unsuitable for customer-facing applications, wherein you are expected to forego FlutterFlow-level design polish for backend power.

2. Steeper Learning Curve

Non-technical professionals struggle with workflow builders and need more training time compared to the intuitive UI of FlutterFlow.

3. Higher Cost of Ownership

You need to incur an exorbitant cost per month for compliance features in addition to per-user fees. This is overkill for early-stage startups.

4. Overkill for Simple Fintech Apps

If you are looking to build an elementary crypto wallet, you will waste resources on unused Mendix enterprise features.

5. Limited Modern API Ecosystem

Integration of Plaid or Stripe takes more time and effort than FlutterFlow. Mendix prioritizes legacy systems over Fintech APIs.

Still Torn Between FlutterFlow and Mendix?

Talk toexperts in building Fintech apps that scale fast and stay secure.

When to Choose FlutterFlow for Your Fintech Project

1. Customer-Facing Apps with Appealing UX

FlutterFlow is ideal for Fintech applications where design wins users like neobanks or trading platforms. In comparison with the template-driven UI of Mendix, you can avail yourself of pixel-perfect control over branding and animations.

2. Speed to Market is Your Top Priority

If you are in desperate need to launch an MVP in weeks and not the customary months, the drag-and-drop builder of FlutterFlow in combination with Firebase integration enables you to launch swifter compared to Mendix, as it gives utmost priority to backend complexity over speed.

3. Your Team is Small or is from a Non-Technical background

If you develop a Fintech app using FlutterFlow, the development process can be completed with one or two developers or even business teams. On the other hand, Mendix has a steeper learning curve, which demands more IT involvement.

4. You want a Mobile-First or Mobile-Only Solution

FlutterFlow compiles natively with iOS or Android with zero extra work. It is a leaner alternative to Mendix for Fintech applications with heavy mobile usage, such as payment gateways.

5. You are Effectively Utilizing Modern Fintech APIs like Firebase, Stripe, and Plaid

FlutterFlow impeccably integrates with Stripe for payment processing, Plaid for KYC, and Firebase for authentication or real-time data. Mendix needs more effort for these. However, it excels with legacy systems.

6. You Require Custom Animations and Micro-Interactions

If you wish to integrate engaging interfaces like balance updates or interactive charts, the Flutter base in FlutterFlow outperforms the rigid templates of Mendix.

When to Choose Mendix for Your Fintech Project

1. For Building a Regulated Financial Product

The in-built SOC2 and GDPR compliance of Mendix is non-negotiable for neobanks or insurers when compared to FlutterFlow, which needs manual setup.

2. Complex Backend Workflows are Non-Negotiable

If you are looking for loan approvals, fraud detection, or risk engines, the visual workflow builders of Mendix hands-on beat the custom-code methodology of FlutterFlow.

3. For Modernizing Legacy Banking Systems

Mendix connects to core banking platforms like FIS out of the box. This gives Mendix a vital edge when you compare FlutterFlow's Mendix finance capabilities.

4. Enterprise Scalability is Non-Negotiable

If you are looking for a framework that can handle millions of transactions, opt for the multi-cloud or on-premise options of Mendix, which has an upper hand over the Firebase dependency of FlutterFlow.

5. Large Teams Need to Collaborate

Mendix allows business analysts and developers to work in a single environment. This is great news when you are carrying out complex projects, compared to the design-first focus of FlutterFlow.

6. Security is of Utmost Importance

If you wish to get granular controls, audit trails, and encryption in your Fintech application, Mendix leads, while FlutterFlow requires add-ons for a similar type of protection.

Industry-Specific Use Cases of FlutterFlow

1. Healthcare

It is effortless to develop HIPAA-compliant patient portals and telemedicine apps. Add-ons and patient interfaces that enable real-time health data tracking are also available.

2. Education

Develop e-learning platforms intuitively with progress tracking, quizzes, and payment gateways for premium courses. FlutterFlow has an edge over Mendix as it performs swifter UI iterations for student-facing applications.

3. Retail and eCommerce

Create loyalty and payment apps with custom-branded UIs with Plaid or Stripe integrations so that there are impeccable checkouts. FlutterFlow framework helps generate animations like product zooms that give a new dimension to the users’ shopping experiences.

4. Agriculture

Make farm management applications with offline-capable field reporting tools with photo uploads and IoT sensor dashboards.

5. Logistics

Develop last-mile delivery applications with driver interfaces using real-time GPS tracking and Firebase push notifications. The biggest advantage of using FlutterFlow is that it helps you make a fully functional MVP before the peak shipping seasons kick in.

6. Finance

You can create crypto wallets and trading UIs with real-time charts, Coinbase API integrations, and secure authentication. FlutterFlow is not ideal for core banking. If you wish to develop core banking applications, opt for Mendix.

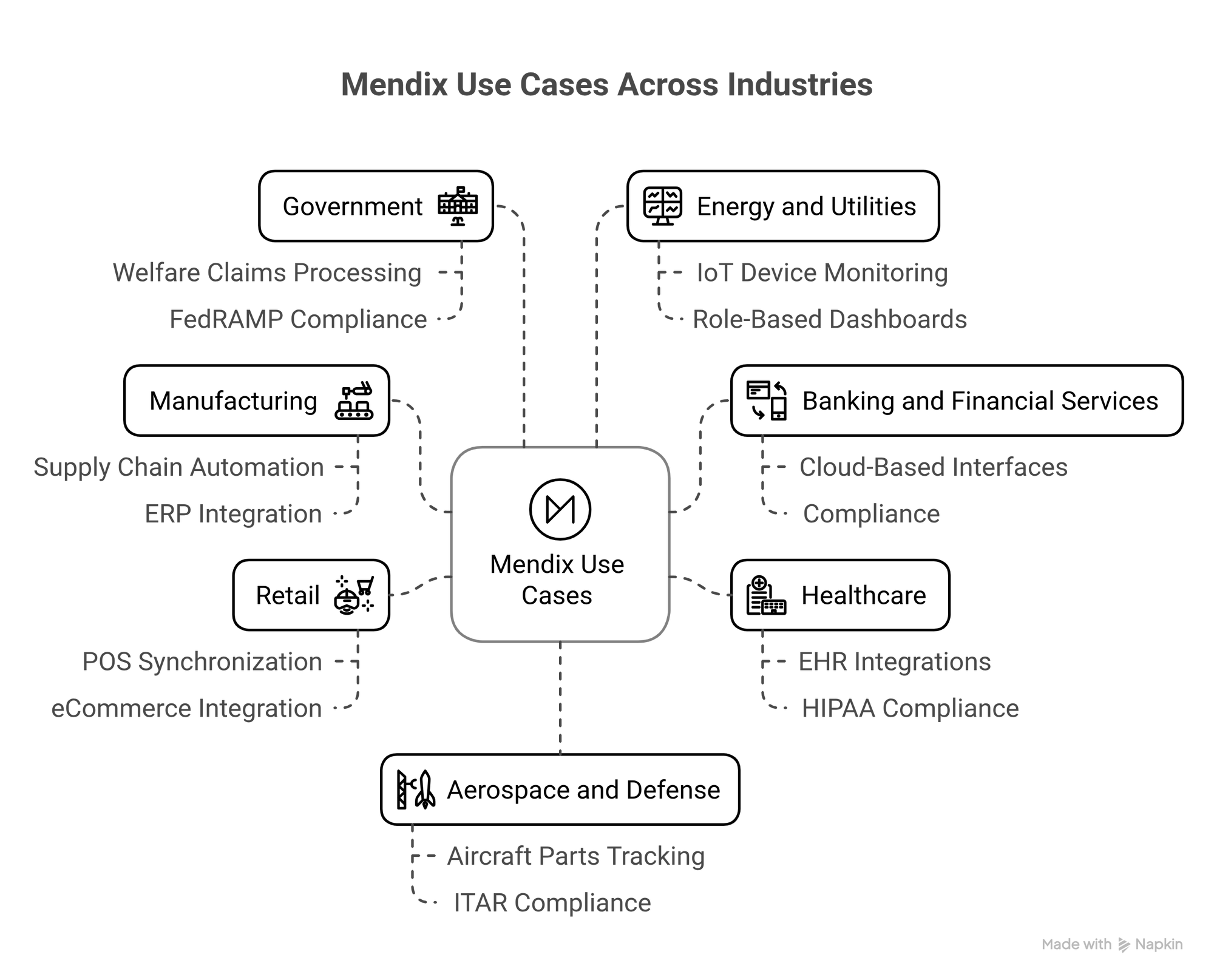

Industry-Specific Use Cases of Mendix

1. Manufacturing

Devise supply chain automation using Mendix's visual workflows for PO approvals, ERP integrations, and inventory alerts. Complex backend logic with legacy systems can be developed seamlessly with Mendix, which is not the case with FlutterFlow.

2. Banking and Financial Services

You can modernize core banking apps by replacing 40-year-old mainframes with cloud-based interfaces without rewriting legacy code. Mendix consists of built-in audit trails for compliance, like Basel III and SOX, to get a regulatory edge.

3. Healthcare (Enterprise Scale)

Develop hospital management systems to manage EHR integrations, billing, and staff scheduling, all with HIPAA-ready workflows. Mendix manages more than 10K daily transactions securely.

4. Retail (Enterpise)

Create Omnichannel inventory hubs that sync POS, eCommerce, and warehouse data across over 1,000 locations. You may use Mendix only for frontend applications like customer loyalty UIs.

5. Government

Devise public benefit platforms to process welfare claims with identity verification and case management. The biggest plus point of Mendix is that it adheres to FedRAMP security standards out of the box.

6. Energy and Utilities

You can curate smart grid control panels to scrutinize IoT devices across power plants with role-based dashboards. Mendix manages terabytes of sensor data on a daily basis.

7. Aerospace and Defense

Develop maintenance logistics that can easily keep track of aircraft parts on a global level using barcode scanning and SAP integration. It also allows you to get ITAR-compliant deployments.

Difference Between FlutterFlow and Mendix for Fintech Projects

| Points of Difference | FlutterFlow | Mendix |

|---|---|---|

| Target Audience | Ideal for startups, solo entrepreneurs, small Fintech teams, and solo developers searching for mobile-first UI | Intended for enterprise Fintech teams with complex app requirements |

| Ease of Use | Very intuitive, visual drag-and-drop requiring minimal learning curve | Steeper learning curve, which is favorable for experienced teams or IT departments |

| Security and Compliance | Provides Firebase-based security but lacks built-in compliance tools like GDPR and SOC2 | Strong enterprise-grade security with built-in support for GDPR, HIPAA, and ISO 27001 |

| Backend Integration | Limited backend alternatives without custom code of Firebase | Powerful backend integration with SOAP, REST, OData, and enterprise systems |

| Speed of Development | Extremely swift for prototypes and MVPs | Slower for initial setup, however, excels in scaling complex workflows |

| Customization and Code Control | Exports clutter-free Flutter code, which is ideal for teams that wish to own and extend code | Uses proprietary runtime, which makes it less flexible for direct code modifications |

| AI and Automation Support | Limited AI tooling, which makes it possible through custom APIs | Built-in support for AI, workflows, and logic automations |

| Cloud Hosting Options | Mostly tied to Flutter, where manual deployment is required for custom clouds | Provides comprehensive Mendix Cloud and options for AWS, Azure, and on-premises |

| App Performance | High performance on mobile, as it depends on the Firebase stack | Optimized for complex business apps, which makes it a slightly heavier footprint |

| Cost | Economical for small teams with a pay-as-you-grow model | Expensive for startups, which makes it more suitable for large-budget enterprise Fintech firms |

| Compliance and Ecosystem Support | Must build manually, for example, KYC, AML, and audit logs | Prebuilt components and templates for compliance-heavy industries |

| Developer Community | Active community of indie developers and mobile-focused startups | An Enterprise Partner network that consists of certified developers who build production-grade apps |

Why Choose Third Rock Techkno for Your Low-Code/No-Code Fintech Projects?

When you compare FlutterFlow and Mendix finance platforms, selecting the right technology is only half the job done.

You also require a FlutterFlow agency that bridges the gap between low-code speed and enterprise-grade outcomes. Here are the reasons why Fintech leaders trust Third Rock Techkno.

1. Proven Fintech Expertise

As an official FlutterFlow partner, we have utilized the FlutterFlow platform to deliver more than 100 Fintech projects like neobanks and RegTech solutions, which shows that we are not just another FlutterFlow company.

2. End-to-End Low-Code Development

As a top FlutterFlow agency, our developers have gained prowess in managing UI and UX design that helps them develop pixel-perfect Fintech interfaces. They also assist in developing complex backend integrations like Plaid, Firebase, and core banking APIs. We harden low-code applications for real finance workloads.

3. Quick MVP Development

We can launch investor-ready prototypes in four to eight weeks, which is quicker compared to traditional agencies.

4. Enterprise-Grade Security

We harden FlutterFlow applications for PCI-DSS and GDPR, which is not true with DIY builds. Mendix projects are pre-configured for SOC2 and have no last-minute compliance services.

5. Global Compliance Know-How

We can navigate through US, EU, and APAC regulations for clients. Our pre-built templates for KYC, AML, and transaction monitoring save four to six months of development time.

6. Future-Proof Scaling

Hire our FlutterFlow developers to migrate from low-code to custom code and scale them beyond platform restraints without requiring any rebuilds.

7. White-Glove Services Model

We have experienced FlutterFlow developers who speak banking and tech language. Our pricing is transparent, unlike other FlutterFlow companies.

Conclusion

When it comes to opting between FlutterFlow and Mendix for your Fintech project, the ultimate onus rests upon the priorities that you set - speed and design flexibility or enterprise-grade security and scalability. FlutterFlow is highly recommended for customer-facing applications and rapid MVPs.

On the other hand, Mendix is clearly the right choice for complex, regulated financial systems. However, keep this in mind: selecting the right low-code platform is just half the battle. You also require an experienced development partner who comprehends both Fintech compliance and cutting-edge development.

This is where Third Rock Techkno’s low-code Fintech expertise shines brightly by providing unparalleled value. Irrespective of whether you wish to develop a FlutterFlow-powered neobank or a Mendix-based core banking solution, our experienced developers make sure that your app is scalable, secure, and market-ready. Contact us today!

FAQs

Which of the two - FlutterFlow or Mendix is ideal for finance apps?

FlutterFlow is ideal for customer-facing Fintech user interfaces, while Mendix works best for complex backend financial workflows.

How do I compare FlutterFlow and Mendix for financial compliance requirements?

Mendix provides built-in SOC2/GDPR tools while FlutterFlow needs more manual security setup; however, it works best for low-risk finance applications.

Which of the two - FlutterFlow or Mendix provides better Fintech API integrations?

FlutterFlow magically interlinks to modern-day APIs like Plaid and Stripe. On the other hand, Mendix integrates better with legacy banking systems.

Should we use FlutterFlow or Mendix for Fintech MVPs as a startup organization?

FlutterFlow gets MVPs to market swifter. However, Mendix scales better if you are developing the next enterprise neobank.