The fintech development opportunities are huge because traditional banks are slow to innovate. Challenger banks and fintech app development companies are stealing market share by building what users actually want. If you can build AI finance apps that solve real problems, you're looking at a potentially massive business.

The finance app development market is exploding, and 2025 is the perfect time to jump in. Personal finance app development has become a goldmine, with the market growing from $132.92 billion in 2024 to an expected $167.09 billion this year - that's a massive 25.7% CAGR (Business Research Company, 2025).

Mobile banking adoption is through the roof. About 64% of millennials now use finance apps regularly, and they're not just checking balances anymore (Federal Reserve Bank of St. Louis). They want AI finance apps that predict their spending, automate savings, and give smart financial advice.

AI in finance apps is projected to hit $26.67 billion by 2026, growing at 23.8% annually (MarketsandMarkets). This isn't just about adding chatbots - we're talking about real intelligence that helps people make better money decisions.

Why now? The personal finance app market has several gaps that smart developers can fill. Most existing apps are either too basic or too complex. People want something that works like having a financial advisor in their pocket, not another spreadsheet app.

This guide covers everything you need to know about finance app development from choosing the right features to picking development platforms, integrating AI, and making money from your app. Whether you're a startup founder or an established business looking to enter fintech, this roadmap will help you build something people actually want to use.

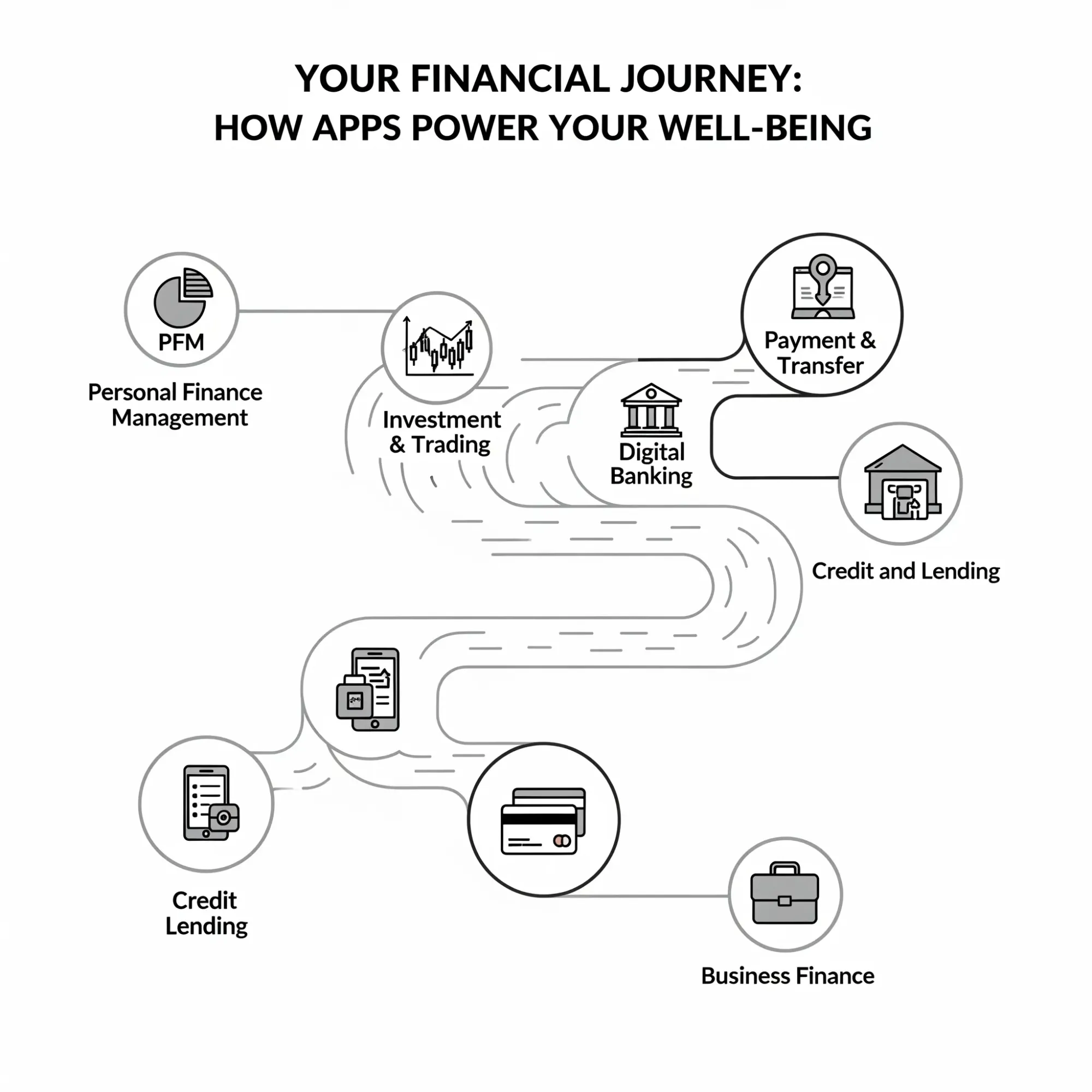

Type of Finance Apps You Can Build in 2025

The personal finance app development space offers multiple opportunities, each targeting different user needs and market segments. Understanding these categories helps you choose the right focus for your finance app development project.

Personal Finance Management Apps

These apps help users manage personal finances through budgeting and expense tracking. Think Mint or YNAB - they categorize expenses automatically, send budget alerts, and help users set financial goals. The target audience is individual consumers who want to understand where their money goes.

AI integration for personal finance apps works great here. Smart categorization learns from user behavior, predictive budgeting forecasts future expenses, and personalized insights help users make better spending decisions. Machine learning finance apps can spot unusual spending patterns and alert users before they blow their budgets.

Investment and Trading Apps

Robo-advisors and portfolio management apps serve retail investors and millennials who want simple investing. Key features include real-time market data, AI-driven recommendations for portfolio balancing, and automated investing based on goals and risk tolerance.

AI technologies for finance apps shine in this category. Predictive analytics can forecast market trends, natural language processing analyzes news sentiment, and machine learning optimizes portfolio allocation. AI integration in finance apps helps users make smarter investment decisions without needing deep market knowledge.

Digital Banking Apps

Neobank solutions and challenger banks target tech-savvy consumers seeking alternatives to traditional banking. These mobile banking app development projects include account management, card controls, spending insights, and often better user experiences than legacy bank apps.

AI features for finance apps in this space include fraud detection, spending categorization, savings recommendations, and chatbot customer service. Firebase ML finance apps can analyze spending patterns and suggest better financial habits.

Payment and Transfer Apps

P2P payments, bill splitting, and international transfers serve all demographics globally. Features include instant transfers, QR code payments, multi-currency support, and integration with various payment networks. Think Venmo, Cash App, or Wise.

AI budgeting app development elements can be added here through smart bill splitting suggestions, currency exchange optimization, and fraud prevention. OpenAI integration with finance apps can power conversational interfaces for payment commands.

Credit and Lending Apps

Credit monitoring, loan applications and BNPL solutions target credti builder and borrowers. Features include credit score tracking, personalized loan offers, payment reminders, and financial education content.

AI personal finance apps excel at credit risk assessment, personalized loan recommendations, and payment behavior analysis. Machine learning finance apps can predict default risk and suggest credit improvement strategies.

Business Finance Apps

Expense management, invoicing, and cash flow analysis serve small businesses and freelancers. Key features include receipt scanning, tax preparation, financial reporting, and integration with accounting software.

Computer vision for document processing works perfectly for receipt scanning and invoice data extraction. AI integration finance apps can categorize business expenses automatically and flag potential tax deductions.

Which Finance App Type Has the Highest ROI?

Based on market data, personal finance management apps and investment apps typically show the highest user engagement and retention rates, leading to better monetization opportunities. However, B2B finance apps often have higher average revenue per user (ARPU) despite smaller user bases.

From App Idea to AI-Powered Reality

Curious if your finance app concept can compete? Let's chat about turning your vision into an intelligent financial solution that users actually want to use.

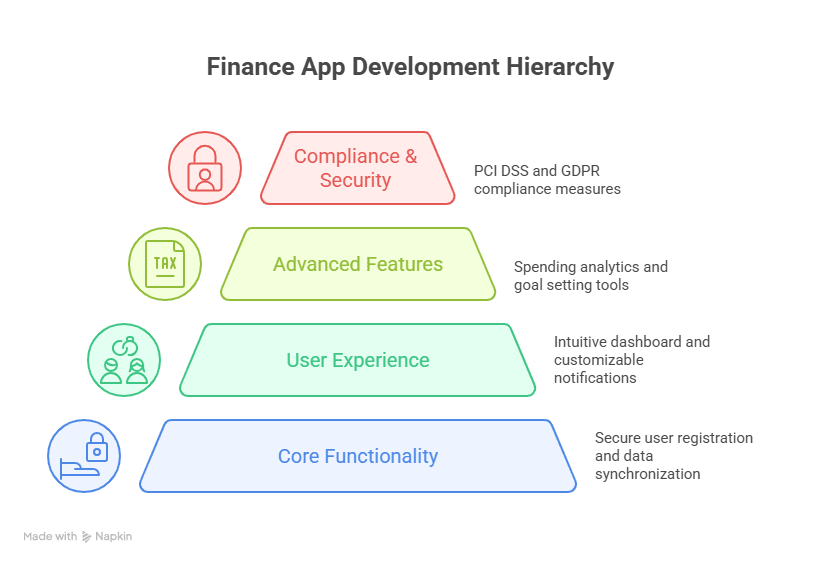

Essential Features Every Finance App Needs

Successful finance app development requires a solid foundation of core features, enhanced user experience elements, advanced capabilities, and strict compliance measures. Here's what every personal finance app development project must include.

Core Functionality

User registration and KYC compliance form the foundation of any financial app. Users need secure account creation with identity verification that meets regulatory requirements. KYC integration finance apps must collect necessary personal information while keeping the process smooth and fast.

Account linking and data synchronization connect users' financial accounts safely. Plaid API integration is the most common solution for US banks, while Open Banking APIs serve European markets. This lets users see all their financial data in one place.

Transaction categorization and tracking automatically sort expenses into categories like groceries, gas, or entertainment. AI integration for personal finance apps makes this process more accurate by learning from user corrections and spending patterns.

Security features like 2FA and biometric authentication protect user data and build trust. PCI DSS compliance finance apps must encrypt sensitive data and use secure authentication methods. Face ID, fingerprint scanning, and SMS codes are standard expectations.

User Experience Features

Intuitive dashboard design presents financial information clearly without overwhelming users. The best personal finance app features show the most important data first account balances, recent transactions, and budget status.

Customizable notifications and alerts keep users informed about their finances. Smart alerts warn about low balances, unusual spending, bill due dates, or budget overages. AI finance apps can personalize alert timing and content based on user behavior.

Multi-device synchronization ensures data stays consistent across phones, tablets, and web browsers. Users switch between devices constantly, so mobile banking app development must support seamless experiences everywhere.

Offline functionality lets users view recent data and add transactions even without an internet connection. This is crucial for finance apps since people need to track expenses anywhere, anytime.

Advanced Features

Spending analytics and insights help users understand their financial patterns. AI in finance apps can identify trends, compare spending to similar users, and suggest areas for improvement. Visual charts and graphs make complex data easy to understand.

Goal setting and progress tracking motivate users to improve their financial health. Whether saving for vacation or paying off debt, AI personal finance apps can calculate realistic timelines and suggest monthly targets.

Bill reminders and recurring payments prevent late fees and missed payments. AI integration in finance apps learns bill patterns and can predict upcoming expenses before they appear on bank statements.

Export and reporting capabilities let users download data for taxes or financial planning. Finance app development projects targeting business users especially need robust reporting features.

Compliance and Security

PCI DSS compliance protects credit card data through strict security standards. Any fintech app development handling payment information must meet these requirements, including encrypted data transmission and secure storage.

GDPR and data privacy regulations govern how apps collect, store, and use personal information. Personal finance app development must include clear privacy policies, user consent mechanisms, and data deletion capabilities.

Fraud detection and prevention protect both users and app operators from financial crimes. AI technologies for finance apps excel at spotting suspicious patterns and blocking fraudulent transactions in real-time.

Encrypted data storage ensures sensitive information stays protected even if systems are compromised. Finance app security features must encrypt data both in transit and at rest using industry-standard methods.

AI Integration: Making Your Finance App Intelligent

AI integration in finance apps transforms basic money management tools into intelligent financial advisors. Smart features by machine learning and artificial intelligence create personalized experiences that adapt to each user's financial behavior and goals.

AI use Case in Fiannce Apps

Automated expense categorization eliminates manual data entry by learning how user classify their spending. Machine learning finance apps analyze transaction descriptions, amounts, and merchant information to automatically sort expense into right categories.

The systems gets smarter with each user correction. Some of the popular example would be Cloud Eagle.ai and IBM Watsonx.

CloudEagle.ai is an AI SaaS procurement platform that helps finance teams optimize software spending, automate renewals, and eliminate waste. It’s one of the best AI tools for finance for companies struggling with shadow IT or overspending on subscriptions.

IBM Watsonx Orchestrate. With customizable AI agents for finance, your teams can automate repetitive tasks, accelerate planning cycles and surface insights faster freeing up time for higher-value work.

Spending pattern analysis and insights reveal hidden financial habits. AI personal finance apps can identify trends like increased dining spending in stressful weeks or seasonal variations in utility bills. These insights help users understand their money behavior and make better decisions.

Predictive budgeting and cash flow forecasting anticipate future financial needs. AI finance apps analyze historical data to predict upcoming expenses, income fluctuations, and potential shortfalls.

Users get early warnings about budget issues before they happen. Some of the popular platforms are Alpha Sense and Kavout.

AlphaSense is a market intelligence platform used by investment banks, hedge funds, and enterprise strategy teams. It uses AI and NLP to sift through millions of financial documents, like SEC filings, earnings transcripts, news articles, and analyst reports, to deliver relevant insights in real time.

Kavout combines machine learning and quantitative models to deliver intelligent stock analysis tools. Its flagship feature, the “Kai Score,” ranks equities based on predictive modeling and fundamental data analysis.

Personalized financial recommendations provide tailored advice based on individual circumstances. AI technologies for finance apps can suggest optimal savings rates, debt payoff strategies, or investment allocations that fit each user's specific situation and goals. Example:- Moneyview and Monarch Money.

Monarch Money, The modern way to manage your money. Monarch makes it easy to track all of your accounts, optimize your spending, analyze your investments, and create a financial plan to achieve your goals.

Moneyview is an Indian fintech platform and digital lender that uses AI to enhance its financial services and internal operations, offering personal loans, digital gold, fixed deposits, and credit cards through its partners.

Fraud detection and risk assessment protect users from financial crimes. AI in finance apps monitors transaction patterns to identify suspicious activity, unusual spending locations, or potentially compromised accounts.

Real-time alerts help prevent losses. There are tons of application offering fraud detection at this point but Darktrace is one of the popular ones.

Chatbot customer support provides instant help for common questions. OpenAI integration in finance apps can answer account queries, explain features, or guide users through complex tasks using natural language processing.

Stop Guessing, Start Building Smart

Tired of wondering which features matter most? Book a strategy call to discover how AI integration can 10x your finance app's user engagement and retention.

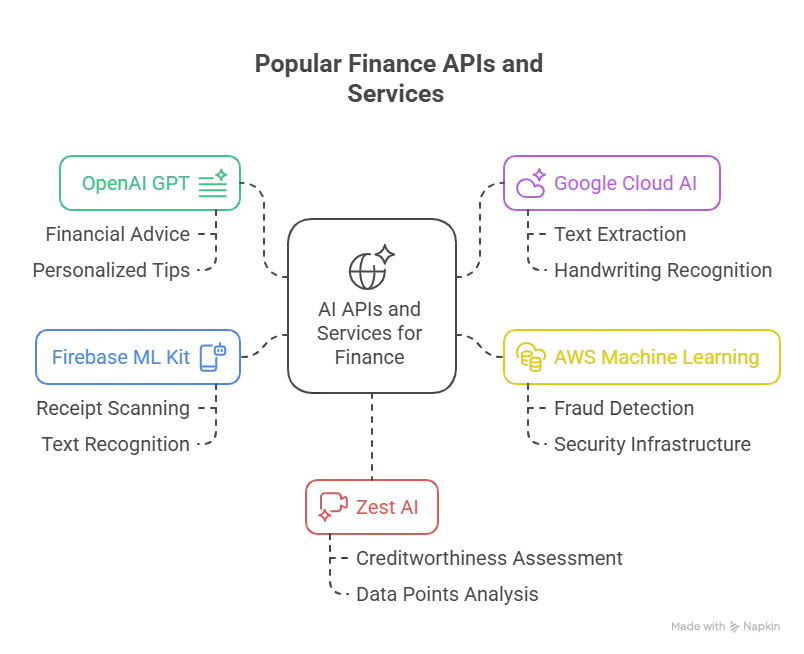

Popular AI APIs and Services

OpenAI GPT for financial advice generation creates personalized tips and explanations in plain language. OpenAI integration finance apps can generate spending summaries, budget recommendations, or educational content tailored to each user's financial situation.

Google Cloud AI for document processing offers pre-trained models for text extraction, handwriting recognition, and document classification. These services accelerate AI integration in finance apps without requiring custom machine learning development.

AWS Machine Learning for fraud detection provides sophisticated algorithms for identifying suspicious transactions and user behavior. AI technologies for finance apps using AWS can leverage pre-built models and extensive security infrastructure.

Firebase ML Kit for mobile AI features brings artificial intelligence directly to smartphones. Firebase ML finance apps can perform on-device processing for features like receipt scanning, text recognition, and basic predictions without internet connectivity.

Zest AI, AI platform that help lenders automate and optimize their lending decisions. It uses machince learning models to assess creditworthiness based on a wide range of data points than traditional credit scores.

Development Platform Comparison

Choosing the right platform for finance app development affects everything from initial costs to long-term scalability. Each approach has distinct advantages depending on your budget, timeline, and technical requirements.

Native Development

Native app development builds separate applications for IOS and Android using platform-specific programming languages. Mobile banking app development often choosen this approach for maximum performance and access to platform-specific features.

Pros include maximum performance optimization, full access to device capabilities, and platform-specific user interface elements that feel natural to users. Finance app security features can leverage the deepest level of operating system integration.

Cons involve higher development costs, longer timelines, and maintaining separate codebases for each platform. Personal finance app development cost typically ranges from $50,000 to $100,000 for native development with advanced features.

Best for large enterprises with substantial budgets, complex requirements that need platform-specific features, or apps where performance is absolutely critical. Fintech app development projects with strict regulatory requirements often prefer native approaches.

Cross-Platform Frameworks

React Native enables finance app development with significant code sharing between iOS and Android platforms. Facebook's backing and large community support make it a popular choice for personal finance app development.

Pros include substantial code reuse (up to 80%), large developer community, and mature ecosystem. AI integration finance apps can leverage React Native's extensive library of machine learning and API integration tools.

Cons involve performance limitations for complex animations, platform-specific bugs, and dependency on Facebook's continued support. Mobile banking app development sometimes encounters limitations with advanced security features.

Best for social-driven finance apps, projects with moderate complexity, and teams with React or JavaScript experience. Cost to develop a personal finance app using React Native typically ranges from $30,000 to $50,000.

Flutter offers Google-backed cross-platform development with single codebase deployment. AI-powered finance apps benefit from Flutter's fast development cycles and consistent user interfaces across platforms.

Pros include truly single codebase, fast development and hot reload, consistent UI across platforms, and growing Google support. Finance app development platforms increasingly choose Flutter for rapid prototyping and MVP creation.

Cons involve newer ecosystem with fewer developers, larger app sizes, and some platform-specific limitations. Personal finance app features requiring deep platform integration may need additional native development.

Best for MVP development, rapid prototyping, and teams wanting consistent user experiences across platforms.

No-Code/Low-Code Platforms

FlutterFlow represents the leading no-code finance app development platform, enabling visual application creation without extensive programming knowledge. FlutterFlow finance app development dramatically reduces both time and costs for many projects.

Pros include visual development interface, quick MVP creation, built-in AI integrations, and significant cost savings of 50-70% compared to traditional development. FlutterFlow development services can create functional prototypes in weeks rather than months.

Cons involve platform limitations for complex features, potential vendor lock-in concerns, and reduced customization flexibility. Custom finance app development requirements may exceed no-code capabilities.

Best for startups, rapid testing, non-technical founders, and AI personal finance apps with standard feature sets. How long does it take to build a finance app using FlutterFlow? Typically 4-12 weeks for basic implementations.

Other platforms include Bubble for web-based applications, Adalo for simple mobile apps, and various specialized fintech development platforms. Each serves different complexity levels and use cases.

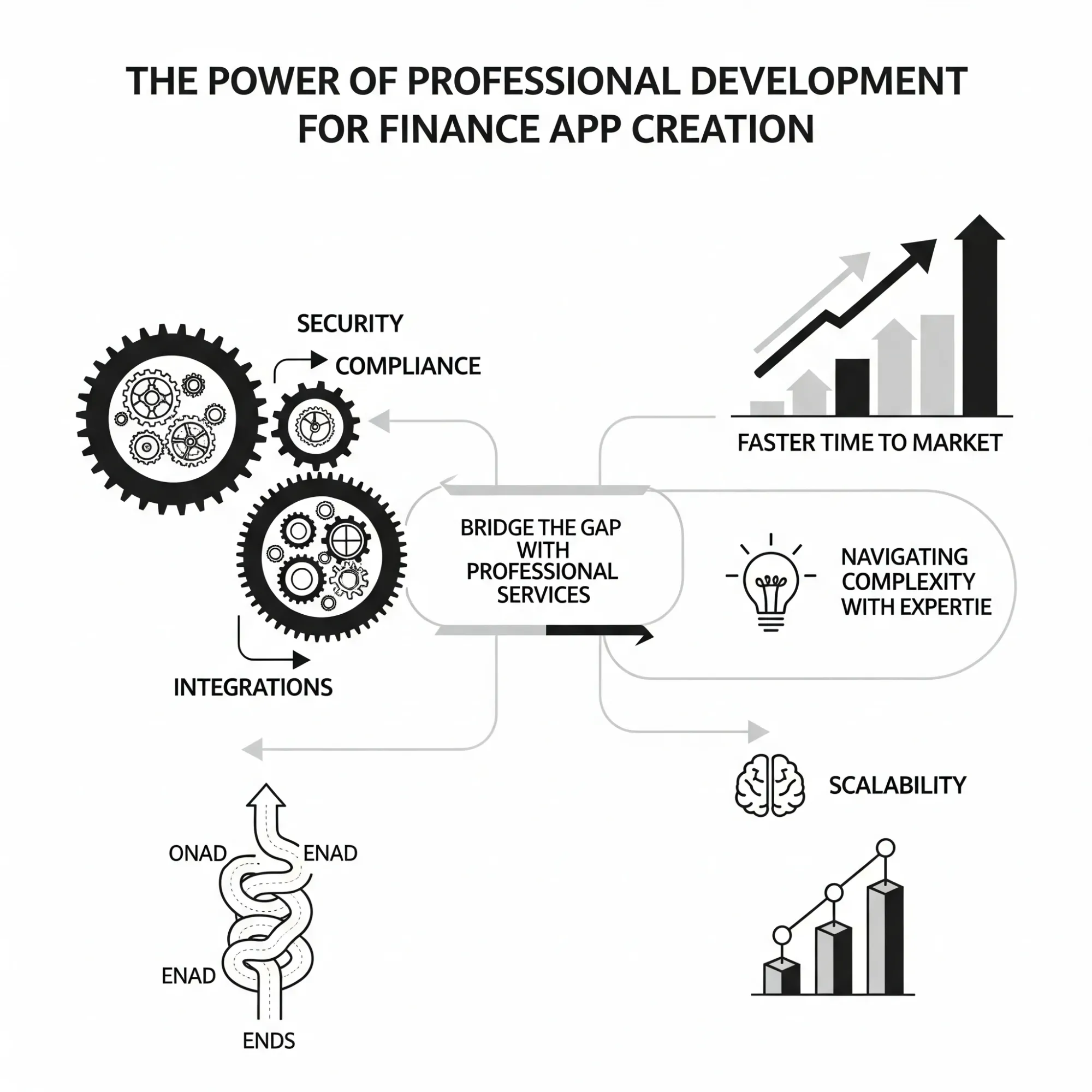

Why Choose Professional Development Services

Finance app development complexity extends far beyond basic mobile app creation. Financial applications require specialized expertise in security, compliance, integrations, and user experience design that most teams lack internally.

Complexity of Finance App Development

Regulatory compliance requirements vary by country, state, and fiancial service type. PCI DSS compliance finance apps must meet strict data security standards, while GDPR compliance affects data collection and user privacy rights. Professional developer understand these complex requirements.

Security implementation challenges are critical for fintech app development. Finance app security features require encryption, secure authentication, fraud prevention, and regular security auditing. Mistake in security implementation can be catastrophic for financial applications.

Integration with financial institutions requires specialized knowledge of banking APIs, payment processors, and data aggregation services. Plaid API integration, Open Banking APIs, and similar services have unique requirements and limitations that experienced developers navigate effectively.

Scalability considerations become important as personal finance apps grow. Professional developers architect applications to handle increasing user loads, data volumes, and feature complexity without performance degradation.

Benefits of Professional Development

Faster time to market results from experience developer's knowledge of common pitfalls, proven architectures, and efficient development processes. Finance app development company services typically reduce development tie by 30-50% compared to internal teams.

Compliance expertise ensures applications meet all necessary regulatory requirements from launch. Fintech development platforms require deep understanding of fiancial regulations that take months or years for internal teams.

Proven development frameworks provide tested solutions for common personal finance app features. Professional developers leverage existing code libraries, security implementations, and integration patterns to avoid rebuilding common functionality.

Post-launch support and maintenance keeps applications updated with security patches, regulatory changes, and new features. Custom finance app development requires ongoing maintenance that internal teams often struggle to provide consistently.

Development Cost Considerations

In-house vs. outsourced comparison typically favors professional development for finance app development projects. Internal development costs include salaries, benefits, training, tools, and infrastructure, often exceeding outsourced project costs by 40-60%.

Hidden costs of DIY development include security vulnerabilities, compliance violations, performance issues, and extended timelines. Personal finance app development cost overruns are common when inexperienced teams underestimate project complexity.

ROI of professional development includes faster launch, reduced risks, higher quality applications, and ongoing support. Finance app development company services typically provide better long-term returns despite higher upfront costs.

Your Competitors Are Already Building - Are You?

Every day you wait, another finance app launches with AI features your users expect. Get your custom development roadmap before your market window closes.

Conclusion

AI finance apps are becoming the standard, not the exception, as users demand intelligent features that help them manage money better. Personal finance app development success requires understanding your target market, choosing the right features, implementing strong security measures, and integrating AI capabilities that provide real value.

FlutterFlow finance app development offers an excellent starting point for many projects, providing visual development tools, built-in AI integrations, and significant cost savings.

However, complex fintech app development projects may require custom solutions or hybrid approaches. The key to successful finance app monetization is providing genuine value to users while implementing sustainable revenue models.

The AI financial solutions market is just getting started, and early movers who implement intelligent features thoughtfully will capture the largest market share.

Don't let technical complexity hold back your finance app vision. Our expert team specializes in FlutterFlow development services and AI integration for personal finance apps, turning concepts into market-ready solutions in weeks, not months.Get Your Custom Development Quote Today!

FAQs

How much does it cost to develop a personal finance app with AI features?

Personal finance app development cost varies by platform and features. FlutterFlow development ranges from $15,000-$20,000, while custom finance app development costs $30,000-$60,000. AI integration for personal finance apps adds 10-20% to base development costs but significantly increases user engagement and retention.

How long does it take to build a finance app using FlutterFlow??

FlutterFlow finance app development typically takes 2-4 weeks for standard features, compared to 6-18 months for native development. AI-powered finance apps with advanced features like machine learning finance apps may require 4-5 weeks depending on complexity and AI integration requirements.

What AI technologies should I include in my finance app?

Essential AI technologies for finance apps include automated expense categorization, spending pattern analysis, and fraud detection. OpenAI integration finance apps can provide personalized financial advice, while Firebase ML finance apps enable receipt scanning and predictive budgeting for better user experiences.

Is FlutterFlow suitable for complex fintech applications?

FlutterFlow works excellently for personal finance app development with standard features and AI integration. However, complex fintech app development requiring advanced security, regulatory compliance, or custom machine learning finance apps may need hybrid approaches or custom finance app development solutions.

What security measures are required for finance app development?

Finance app security features must include PCI DSS compliance, encrypted data storage, 2FA authentication, and fraud detection systems. Personal finance app development requires KYC integration, secure API integrations like Plaid, and regular security audits to protect user financial data.

How can I monetize my AI-powered finance app effectively?

Successful finance app monetization combines freemium subscriptions ($3-15/month), transaction fees (0.25-2%), and affiliate partnerships. AI personal finance apps with intelligent features achieve higher conversion rates and user retention, leading to better long-term revenue from premium subscriptions and financial product recommendations.