In today's hyperconnected financial ecosystem, the right set of best fintech APIs can mean the difference between market leadership and obsolescence. As we navigate 2025, financial technology APIs have reached unprecedented sophistication, serving as the critical connective tissue binding innovative finance software together in the world of digital banking and financial services.

The global API management market is experiencing significant growth, projected to reach around $43.8 billion by 2032, with a compound annual growth rate (CAGR) of approximately 34.7% from 2024 to 2032.

Having advised Fortune 500 companies on their digital transformation strategies for over two decades, I've witnessed firsthand how finance software APIs have evolved from simple data connectors to sophisticated engines driving entirely new business models.

According to recent data from Gartner, organizations that strategically implement fintech API platforms experience 35% faster time-to-market and a 42% reduction in development costs compared to their competitors.

This comprehensive guide cuts through the noise to deliver actionable insights on the most powerful top fintech APIs 2025 available today.

Whether you're looking to revolutionize payment processing, harness the power of open banking, implement cutting-edge blockchain solutions, or enhance your wealth management offerings with banking API solutions, this analysis will help you make informed decisions that drive your organization forward.

What Are Fintech APIs? Complete Guide to Fiance Software Integration

Financial technology APIs (Application Programming Interfaces) are specialized software intermediaries that allow different financial software applications to communicate with each other.

Unlike general-purpose APIs, finance software APIs are specifically designed to handle sensitive financial data, maintain regulatory compliance, and facilitate secure transactions across banking, payments, lending, and other financial domains.

The technical architecture of modern fintech APIs has evolved significantly since 2020. While RESTful APIs remain common, we're seeing increased adoption of GraphQL for its flexibility and efficiency in data retrieval.

According to a 2024 study by API Evolution Research, GraphQL adoption in financial services has grown by 78% since 2022, primarily due to its ability to minimize network overhead and precisely deliver the requested data.

| Architecture Type | Adoption Rate | Key Advantages | Best For |

|---|---|---|---|

| RESTful APIs | 68% | Simplicity, caching, statelessness | General-purpose integration |

| GraphQL | 27% | Precise data retrieval, reduced overhead | Data-intensive applications |

| WebSockets | 18% | Real-time data streaming, persistent connection | Trading, live monitoring |

| Webhooks | 62% | Event-driven architecture, push notifications | Transaction alerts, updates |

The most sophisticated fintech API platforms now incorporate:

- Real-time streaming capabilities via WebSockets

- Advanced authentication through OAuth 2.0 and Two-Factor Authentication (2FA)

- Robust data encryption both in transit and at rest

- Comprehensive audit logging for regulatory compliance

- Webhooks for event-driven architecture

- Sandboxed testing environments for fintech API integration

Why Fintech APIs Are Essential for Modern Finance Software Development

The strategic importance of finance software APIs cannot be overstated. According to McKinsey's 2024 Banking Technology Report, financial institutions leveraging third-party fintech APIs reduced their product development cycles by an average of 68% while simultaneously expanding their service offerings by 47%.

Accelerating Development and Reducing Time-to-Market

Building financial functionality from scratch is prohibitively time-consuming and resource-intensive. By implementing proven best fintech API solutions, development teams can focus on creating unique value propositions rather than reinventing fundamental capabilities.

Modern fintech API integration reduces development timelines by an average of 60% allowing organizations to bring finance software solutions to market faster than ever before.

Enhancing Finance Software Functionality with Ready-to-Use APIs

Modern financial technology APIs offer sophisticated capabilities that would be impractical to develop internally. From advanced fraud detection algorithms using machine learning to complex trading mechanisms, these banking APIs encapsulate years of specialized development and expertise that would otherwise require massive investment and specialized talent.

Finance software platforms leveraging comprehensive fintech API integration can offer enterprise-grade functionality without the corresponding development overhead.

Enabling Financial System Interoperability Through Banking APIs

The fragmented nature of financial infrastructure has historically created silos that hamper innovation. Banking APIs bridge these gaps, allowing seamless integration between legacy systems and cutting-edge applications through microservices and API gateways. The International Data Corporation (IDC) estimates that improved interoperability through APIs generated $87 billion in value for the financial services industry in 2024 alone.

The international Data Corporation (IDC) estimates that improved interoperability through fintech APIs generated $87 billion in value for the financial services industry in 2024 alone.

Facilitating Compliance With Financial Regulations

Financial services remain one of the most heavily regulated industries globally. Modern fintech APIs incorporate regulatory compliance as a core feature, automatically handling complex requirements like anti-money laundering (AML) checks, know-your-customer (KYC) procedures, and transaction monitoring. This dramatically reduces the compliance burden while ensuring consistent adherence to evolving regulations.

This dramatically reduces the compliance burden for finance software developers while ensuring consistent adherence to evolving regulations.

Cost-Effectiveness of API Integration vs. Custom Development

The economic case for fintech API adoption is compelling. A 2024 analysis by Financial Technology Partners found that financial institutions saved an average of $3.2 million per major project by leveraging specialized banking APIs rather than developing equivalent functionality in-house.

This cost advantage becomes even more significant when factoring in maintenance, security updates, and ongoing compliance requirements for finance software.

Top Categories of Fintech APIs for Finance Software in 2025

A. Best Payment Processing APIs

Payment processing APIs remain the cornerstone of financial software services, with payment gateway APIs handling everything from simple credit card transactions to complex international settlements and buy now, pay later (BNPL) options. These financial APIs are essential for any business requiring seamless payment integration.

Top Payment Processing APIs:

| API | Processing Volume | Developer Experience | Global Coverage | Fraud Protection | Key Differentiator |

|---|---|---|---|---|---|

| Stripe | $800B+ annually | ★★★★☆ | 50+ countries | Advanced ML | Developer experience |

| PayPal | $1.2T+ annually | ★★★☆☆ | 200+ markets | Risk management | Consumer trust |

| Adyen | $720B+ annually | ★★★★☆ | 90+ markets | RevenueProtect | Authorization rates |

| Square | $170B+ annually | ★★★☆☆ | 15+ countries | Integrated tools | SMB focus |

| Checkout.com | $230B+ annually | ★★★☆☆ | 45+ markets | Transaction routing | Authorization uplift |

Stripe continues to dominate the payment API processing landscape in 2025, processing over $800 billion annually across 50+ countries. Their fintech API platform stands out for its exceptional developer experience, comprehensive API documentation, and robust reliability (99.99% uptime in 2024).

Key strengths include their unified platform for online and in-person payments, advanced fraud prevention with Radar using machine learning, support for 135+ currencies, and comprehensive subscription management capabilities, making it one of the best fintech APIs for finance software development.

PayPal's API suite has undergone significant modernization, making it a powerful banking API contender in 2025. With over 400 million active users globally, PayPal offers unparalleled reach and consumer trust.

Their fintech API integration delivers simplified checkout experiences that drive higher conversion rates, while advanced risk management tools and seamless cross-border ommerce capabilities make them particularly strong for international finance software applications.

Adyen has emerged as the preferred payment processing API for enterprise-scale operations, particularly those with global footprints. Their unified commerce approach provides consistent experiences across channels with superior authorization rates (industry-leading by 3%).

Their fintech API offers transparent intercahnge++ pricing models that require significant volume to maximize value.

Square continues to excel in the SMB space while making significant inroads into mid-market organizations. Their financial API platform has matured considerably since 2020, offering integrated in-person and online payment processing alongside comprehensive business management tools.

Their straightforward payment API pricing at 2.6% + $0.10 per transaction makes them particularly attractive for finance software with higher average transaction values.

Checkout.com has solidified its position as a premium payment gateway API provider focused on maximizing authorization rates and providing deep insights. Their industry-leading authorization rates (up to 6% higher than competitors) and unified fintech API across all payment methods make them attractive for finance software where maximum conversion is critical.

Key Implementation Considerations for Payments APIs:

- Conversion optimization capabilities through API integration.

- Compliance with regional regulations (particularly PSD2 in Europe).

- Chargeback and dispute management features via financial APIs.

- Tokenization and data encryption measures.

- Settlement timing and reconciliation processes.

- Fintech API security protocols and fraud prevention.

B. Banking APIs and Open Banking Solutions for Finance Software

The open banking revolution has fundamentally transformed how financial data is accessed and shared through banking APIs. In 2025, banking API solutions offer unprecedented visibility into accounts, transactions, and financial behaviors, making them essential fintech APIs for modern finance software development.

Leading Banking APIs and Open Banking Platforms

| API | Institution Coverage | Real-time Capabilities | Data Enrichment | Account Types | Regional Strength |

|---|---|---|---|---|---|

| Plaid | 12,000+ institutions | ★★★☆☆ | ★★★☆☆ | Banking, investment, credit | North America |

| TrueLayer | 3,000+ institutions | ★★★★☆ | ★★☆☆☆ | Banking, payment initiation | Europe |

| Railsr | 50+ core integrations | ★★★★☆ | ★★☆☆☆ | Full banking-as-a-service (BaaS) | Global |

| Tink | 3,400+ institutions | ★★★☆☆ | ★★★★☆ | Banking, mortgage, pension | Europe |

| MX | 16,000+ connections | ★★☆☆☆ | ★★★★★ | Banking, investment, lending | North America |

Plaid has maintained its position as the market leader in banking API aggregation, despite increased competition. Their network now encompasses over 12,000 financial institutions globally, providing exceptional account authentication and verification, transaction enrichment with merchant identification, and comprehensive investment account data aggregation.

Plaid's fintech API pricing structure remains volume-based, typically starting at $0.25-0.50 per connected account monthly, making it one of the most accessible banking APIs for finance software startups.

TrueLayer has emerged as Europe's dominant open banking API provider, capitalizing on PSD2 regulations to deliver robust connectivity across the region. Their standout banking API features include pan-European coverage with local regulatory compliance, account information and payment initiation services, and recurring payment capabilities with enhanced user verification and authentication, establishing them as the best fintech API for European finance software applications.

Railsr has evolved from basic banking-as-a-service (BaaS) to a comprehensive embedded finance platform, allowing companies to integrate complex financial services through their banking APIs.

They provide full banking infrastructure via API, card issuing and processing, global IBANs and accounts, and integrated credit products with comprehensive compliance support.

Tink has expanded beyond its European roots to become a global player in open banking infrastructure, offering enhanced data services beyond basic banking API connectivity. Their account aggregation spans 18 European markets with personal finance management tools, risk insights, and sophisticated income verification capabilities through their financial APIs.

MX differentiates itself through superior data cleansing and enrichment, transforming raw financial data into actionable insights via their banking APIs. Their artificial intelligence-powered financial health scores, comprehensive money management tools, and advanced analytics provide sophisticated user segmentation and targeting capabilities,making them essential fintech APIs for data-driven finance software.

Banking API Implementation considerations: When selecting banking APIs for finance software, organizations should evaluate.

According to the Open Banking Impact Report 2024, institutions implementing open banking APIs have seen:

- 31% increase in customer acquisition through fintech API integration.

- 27% reduction in onboarding costs via automated banking APIs.

- 42% improvement in credit decision accuracy using financial APIs.

- 63% enhancement in fraud detection capabilities.

Implementation Considerations:

When selecting banking APIs, organizations should evaluate:

- Coverage of relevant financial institutions

- Data refresh frequency and reliability of fintech APIs.

- Enrichment capabilities beyond raw banking API feeds.

- API security and compliance certifications.

- User experience during authentication flows.

- Fintech API integration complexity and developer support.

- Pricing model for banking as a services offerings.

C. Financial Data and Analytics APIs

Financial data APIs provide the raw material for informed decision-making, offering access to market data, company fundamentals, alternative data sets, and sophisticated analytics through big data analytics.

Leading Financial Data and Analytics APIs.

| API | Data Sources | Coverage | Historical Depth | Update Frequency | Key Strength |

|---|---|---|---|---|---|

| Yodlee | 18,000+ | Global | 25+ years | Near real-time | Transaction enrichment |

| Finicity | 10,000+ | US-focused | 10+ years | Real-time | Lending verification |

| Refinitiv | 500+ exchanges | Global markets | 50+ years | Milliseconds | Institutional quality |

| Bloomberg | 330+ exchanges | Global markets | 80+ years | Real-time | Reference data |

| Xignite | 250+ sources | Global markets | 25+ years | Milliseconds | Cloud computingarchitecture |

Yodlee has leveraged its long history in financial data aggregation to build one of the most comprehensive financial data API platforms available. With data from over 18,000 global sources and 25+ years of historical transaction data, they offer advanced data enrichment, categorization, and predictive analytics with extensive compliance certifications, making them one of the best fintech APIs for finance software requiring comprehensive data coverage.

Finicity (acquired by Mastercard) has expanded its financial API offerings while maintaining its reputation for accuracy and reliability in fintech API integration. Their real-time account verification, cash flow analytics, and specialized mortgage verification reports make them particularly strong for lending use cases and banking API applications requiring precise financial data.

Refinitiv (LSEG Data & Analytics) provides institutional-grade financial data APIs and analytics, serving the needs of sophisticated financial software operations. Their real-time market data spans all asset classes with comprehensive company fundamentals, ESG scores, and economic indicators, establishing them as a premiun fintech API for institutional applications.

Bloomberg API provides programmatic access to the industry-standard Bloomberg Terminal data, offering unparalleled depth for investment applications and finance software. Their comprehensive market data covers global markets with reference data for 50+ million securities and sophisticated analytics engines, making them the gold standard among financial APIs for professional trading and investment platforms.

Xignite specializes in cloud computing-delivered financial market data through their, offering flexible delivery models for diverse use cases. Their cloud-native architecture provides 99.99% uptime with comprehensive market data coverage at cost-effective pricing models suitable for both startups and enterprises requiring financial data APIs.

Data Security Considerations:

Financial data APIs Security and Compliance Financial APIs require exceptional attention to security and privacy. Key considerations include:

- Data residency and sovereignty requirements for fintech API integration.

- End-user consent management through banking APIs.

- Data encryption standards (minimum AES-256)

- API authentication and access controls.

- Audit trails and compliance reporting.

- Fintech API security protocols and data protection mesaures.

According to the Financial Data Security Council, organizations implementing comprehensive API security measures experienced 76% fewer data incidents than those with baseline protections, highlighting the critical importance of robust fintech API security in financial API implementations.

D. Best Investment APIs for Finance Software Development

Investment APIs have democratized access to markets, enabling organizations to build sophisticated trading capabilities without massive infrastructure investments. These APIs are particularly important for wealth management and robo-advisors in fiance software.

Leading Investment APIs for 2025

| API | Commission Structure | Asset Classes | Market Coverage | Advanced Orders | Execution Speed (ms) | Price Improvement |

|---|---|---|---|---|---|---|

| Alpaca | Commission-free | Stocks, ETFs | US markets | Yes | 172 | $0.0015/share |

| Interactive Brokers | Volume-tiered | Multi-asset | 150+ markets | Extensive | 94 | $0.0047/share |

| Tradier | $0.35/contract | Stocks, options | US markets | Yes | 156 | $0.0021/share |

| TD Ameritrade | $0 stocks/ETFs | Multi-asset | US markets | Yes | 143 | $0.0018/share |

| Robinhood | Commission-free | Stocks, crypto | US markets | Limited | 182 | $0.0009/share |

Alpaca has emerged as the developer-focused investment API platform of choice for building investment applications, offering commission-free trading via fintech API. Their key strengths include commission-free stock trading, real-time and historical market data, fractional shares support, and comprehensive paper trading environments for testing, making them one of the best fintech APIs for investment platform development.

Interactive Brokers provides institutional-grade investment API access with global market coverage and sophisticated order types through their fintech API platform. Their access to 150+ global markets with multi-asset class support, advanced order types, and comprehensive historical data makes them ideal for sophisticated finance software trading applications.

Tradier offers flexible brokerage investment APIs with transparent pricing, catering to both individual developers and enterprise finance softwar platforms. Their equity and options trading, streaming market data, and white-label capabilities make them attractive for platform buildersr requiring robust fintech API integration.

TD Ameritrade (now part of Charles Schwab) maintains a powerful investment API platform for retail trading applications. Their stocks, ETFs, options, and futures trading capabilities with streaming market data and comprehensive option chain analytics continue to attract finance software developers.

Robinhood's impact on the industry warrants inclusion, despite limited official investment API support. Third-party solutions enable integration with their commission-free trading model, fractional shares, and cryptocurrency trading capabilities for finance software

Implementation Considerations:

Investment API Implementation Considerations: When implementing investment APIs in finance software, organization should evaluate

- Regulatory compliance requirements in target markets.

- Account opening and KYC/AML integration via banking APIs.

- Order execution quality and routing practices.

- Real-time data requirements and costs for fintech API integrations.

- Risk management and position limitation tools.

- API security protocols for financial transactions.

E. Blockchain and Cryptocurrency APIs

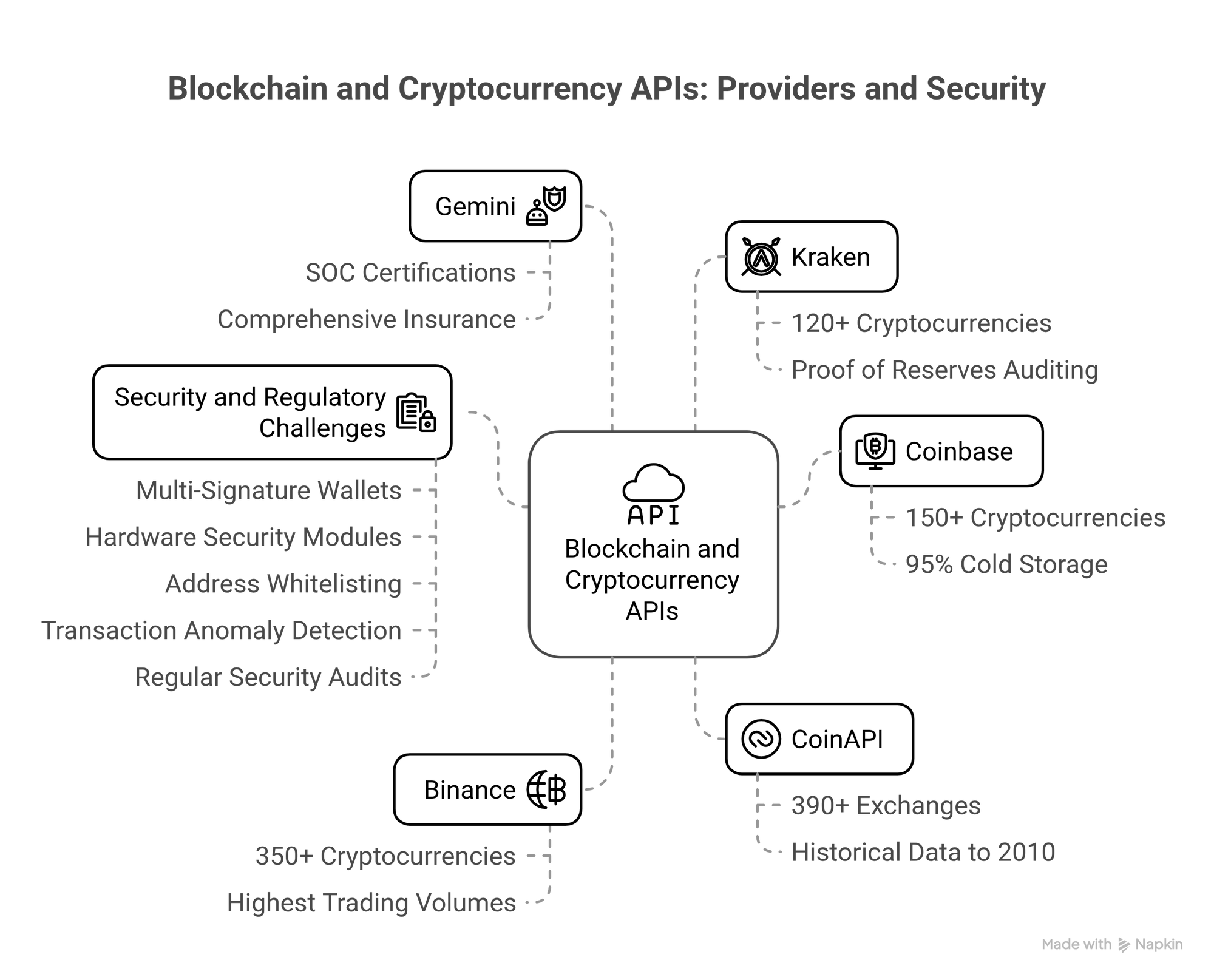

Blockchain APIs for finance enable organizations to incorporate digital wallets and cryptocurrency into their financial applications without managing complex infrastructure. These APIs are essential for DeFi (Decentralized Finance) integration. These fintech APIs are essential for DeFi (Decentralized Finance) integration and modern finance software development.

Coinbase has established itself as an enterprise-grade cryptocurrency platform, with comprehensive fintech API capabilities and institutional focus. Supporting 150+ cryptocurrencies with advanced security features (95% cold storage) and fiat on/off ramps in 100+ countries, they offer institutional-grade custody solutions with comprehensive compliance tools, making them one of the best fintech APIs for finance software requiring regultory compliance.

Binance offers the most comprehensive crytpto trading API in terms of supported assets and global liquidity. Their support for 350+ cryptocurrencies with the highest global trading volumes makes them appealing for finance software applications requiring maximum asset coverage and liquidity through their blockchain API platform.

CoinAPI specializes in cryptocurrency market data, offering standardized access across hundreds of exchanges through their fintech API. Their unified data from 390+ exchanges with historical data dating to 2010 provides standardized symbology and comprehensive market coverage for finance software requiring reliable crypto APIs.

Gemini focuses on regulatory compliance and security, making it suitable for regulated financial institutions entering the crypto space through blockchain APIs. Their SOC certifications, sophisticated custody solutions, and comprehensive insurance coverage reduce implementation risk for regulated entities building finance software.

Kraken provides a balance of extensive asset support, security, and advanced trading features through their cryptocurrency API. Supporting 120+ cryptocurrencies with advanced order types, proof of reserves auditing, and institutional-grade custody solutions, they maintain strong regulatory compliance globally, establishing them as a premium fintech API for institutional finance software.

Security and Regulatory Challenges:

Blockchain API Security and Regulatory Challenges: Cryptocurrency API integration presents unique security challenges. According to Chainalysis's State of Crypto Security 2024, organizations should implement:

- Multi-signature wallet architectures blockahin APIs.

- Hardware security modules for key storage.

- Comprehensive address whitelisting crypto APIs.

- Transaction anomaly detection using artificial intelligence.

- Regular security audits and penetration testing for fintech API security.

Regulatory frameworks continue to evolve rapidly, with significant variations by jurisdiction. The Financial Action Task Force recommends specific compliance measures for virtual asset service providers that should be incorporated into any blockchain API implementation strategy for finance software.

F. Identity Verification and KYC APIs

Identity verification APIs have become a critical component of financial services, with specialized APIs streamlining KYC APIs processes while enhancing security and compliance. These fintech APIs are essential for regulatory compliance in financial software services.

| API | Document Coverage | Biometric Verification | Business Verification | Global Coverage | Processing Time |

|---|---|---|---|---|---|

| Onfido | 4,500+ document types | Advanced liveness | Limited | 195+ countries | 15 seconds avg. |

| Jumio | 3,500+ document types | Video verification | Comprehensive | 200+ countries | 30 seconds avg. |

| Veriff | 10,000+ document types | NFC-enhanced | Yes | 190+ countries | 6 seconds avg. |

| Trulioo | 5,000+ document types | Basic | Comprehensive | 195+ countries | 60 seconds avg. |

| Persona | Customizable | Liveness detection | Yes | 200+ countries | 12 seconds avg. |

Onfido has emerged as the leader in artificial intelligence-powered identity verification APIs, offering document and biometric solutions with exceptional accuracy for finance software. Their document verification across 4,500+ document types with facial biometric verification, seamless omnichannel integration, and customizable workflow management provides flexibility while maintaining global compliance, making them one of the best fintech APIs for KYC integration.

Jumio provides end-to-end identity verification with advanced orchestration capabilities for complex KYC workflows in finance sfotware. Their AI-powered verification with video authentication, continuous monitoring capabilities, and advanced fraud detection systems make them attractive for organizations with sophisticated compliance requirements their fintech API platform.

Veriff differentiates through its decision engine accuracy and exceptional fraud prevention capabilities via their identity verfiication API. Their verification across 10,000+ document types with NFC scanning for chip-based documents and sophisticated spoofing detection delivers industry-leading security for finance software applications.

Trulioo specializes in global identity verification with exceptional coverage in emerging markets and challenging jurisdictions. Their coverage across 195+ countries with business verification capabilities, AML watchlist screening, and ultimate beneficial owner verification makes them particularly strong for global organizations.

Persona offers a highly flexible identity verification platform with dynamic workflow capabilities and an exceptional developer experience. Their no-code workflow configuration, dynamic document selection, and comprehensive case management provide maximum implementation flexibility for fintech API integration in finance software.

Regulatory Compliance Features:

KYC API REgulatory Compliance Features: Identity verification APIs must address increasingly complex regulatory requirements. Key capabilities include:

- Sanctions and PEP screening through KYC APIs.

- Risk-based approach implementation via fintech APIs.

- Ongoing monitoring capabilities for finance software.

- Auditability and record retention identity verification APIs.

- Cross-border compliance management.

- API security protocols for sensitive personal data.

According to the KYC Benchmark Report 2024, organizations implementing API-driven verification reduced compliance costs by 47% while improving accuracy by 31% highlighting the value of identity verification APIs in finance software development.

How to Select the Right Fintech APIs for Your Business

Selecting appropriate fintech APIs requires a structured approach to ensure alignment with business objectives and technical requirements for successful finance software development.

Defining Your Requirements and Use Cases

Begin by clearly articulating what fintech API functionality you need and how it serves your broader finance software goals. Document specific use cases with acceptance criteria and performance expectations. This foundation enables effective evaluation of potential banking API providers against concrete requirements rather than marketing claims.

Evaluating API Documentation and Developer Support

The quality of fintech API documentation often predicts implementation success. According to a 2024 Developer Experience Survey, 76% of failed API integrations resulted from inadequate documentation or support.

Key evaluation criteria for fintech API providers.

- Interactive API explorers and reference documentation.

- Comprehensive code samples in relevant languages.

- Detailed error code documentation for fintech API integrations .

- Active developer forums or communities.

- Responsive support channels with reasonable SLAs.

- Fintech API testing environemnt and sandbox access.

Assessing Security and Compliance Features

Financial APIs demand exceptional security practices. Evaluate potential fintech API providers against these criteria:

- SOC 2 Type II compliance (minimum).

- PCI DSS compliance for payment API handling.

- Implementation of OAuth 2.0 with PKCE for banking APIs.

- Robust data encryption practices (TLS 1.3+)

- Regular penetration testing and vulnerability assessments.

- Comprehensive audit logging capabilities for finance software.

- Fintech API security certification and compliance frameworks.

Analyzing Pricing Models and Cost Structure

Fintech APIs pricing structures vary widely and can significantly impact the total cost of ownership. Consider:

- Transaction-based vs. subscription pricing for payment APIs.

- Volume discounts and tiering structures

- Hidden costs (support, additional features, overages)

- Minimum commitments and contract terms for banking APIs.

- API integration Geographic or feature-based pricing variations

Understanding the full cost implications beyond the headline fintech API pricing is essential for accurate budgeting and ROI analysis finance software projects.

Integration Best Practices for Fintech APIs

Successful fintech API integration requires attention to security, reliability, and performance considerations throughout the development lifecycle of finance software.

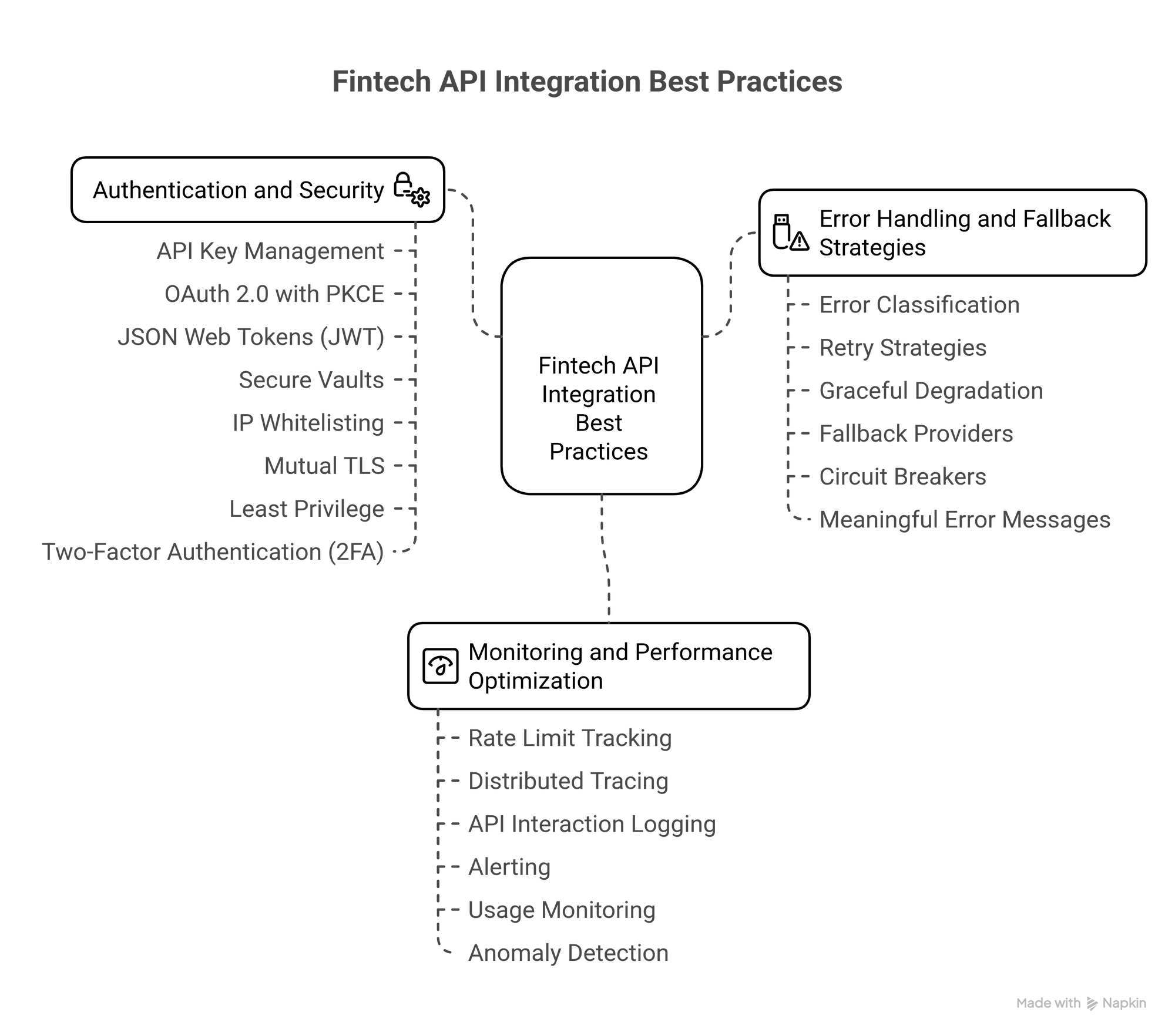

Authentication and Security Best Practices

Financial API security demands multiple layers of protection:

- Implement proper API key management with regular rotation.

- Use OAuth 2.0 with PKCE for user authorization flows in banking APIs.

- Implement JSON Web Tokens (JWT) for secure fintech API communication.

- Store sensitive credentials in secure vaults (e.g., HashiCorp Vault, AWS Secrets Manager).

- Implement IP whitelisting for server-to-server API integrations.

- Use mutual TLS for high-security fintech API integrations.

- Follow the principle of least privilege for all financial API credentials.

- Consider implementing two-factor authentication (2FA) for sensitive operations.

According to the OWASP API Security Project, broken authentication remains the most common vulnerability in financial API implementations, emphasizing the importance of robust fintech API security.

Error Handling and Fallback Strategies

Robust error handling improves fintech API reliability and user experience:

- Implement comprehensive error classification and handling for banking APIs.

- Develop intelligent retry strategies with exponential backoff.

- Create graceful degradation paths for critical finance software functions.

- Maintain fallback providers for essential fintech API services.

- Implement circuit breakers to prevent cascading failures.

- Provide meaningful error messages to end-users without exposing sensitive details.

- API monitoring and alerting for proactive issuse resolution.

Monitoring and Performance Optimization

Effective operational visibility requires comprehensive fintech API monitoring:

- Track API rate limits and usage patterns for all fintech API monitoring.

- Implement distributed tracing for complex fintech API request flows

- Log all API interactions with appropriate detail levels

- Create alerting based on error rates and response times

- Monitor daily/monthly usage against quotas and budgets

- Implement anomaly detection for unusual fintechAPI behavior using machine learning

The FinOps API Usage Report 2024 found that organizations with mature API monitoring reduced their fintech API costs by an average of 23% through optimized usage patterns.

Case Studies: Successful Fintech API Implementations

Case Study 1: Neobank Launch Using API-First Strategy

Company: Velo Bank (pseudonym)

Challenge: Launch a full-service digital banking platform within 6 months with limited development resources.

Challenge: Launch a full-service digital banking platform within 6 months with limited development resources.

Solution: API-first architecture using banking-as-a-service and specialized fintech API providers

Velo Bank adopted a composable architecture, selecting specialized APIs for each core function:

- Core banking: Railsr for account infrastructure via banking APIs.

- KYC/AML: Onfido for identity verification APIs.

- Payments: Stripe for card payment processing APIs and transfers.

- Data enrichment: MX for transaction categorization through financial APIs.

- Customer engagement: Twilio for communication API integratoins.

Results:

- Launched fully compliant neobanking services in 4.5 months (vs. industry average of 18 months)

- Reduced development costs by 68% compared to building finance software in-house.

- Achieved 99.98% system reliability from day one through robust fintech API integrations.

- Onboarded 50,000 customers in the first quarter post-launch.

- Maintained a lean engineering team of just eight developers.

Key Learnings:

- Prioritize fintech APIs with robust sandbox environments for faster API integration

- Establish a clear API governance framework from the beginning.

- Implement comprehensive monitoring across all fintech API integrations.

- Create fallback options for critical customer journeys.

- Maintain strong relationships with fintech API providers for priority support.

Case Study 2: Traditional Bank's Digital Transformation with APIs

Company: Regional Trust Bank (pseudonym)

Challenge: Modernize legacy infrastructure to compete with fintech challengers.

Solution: API gateway strategy to expose legacy systems securely through modern fintech API integration.

Challenge: Modernize legacy infrastructure to compete with fintech challengers.

Solution: API gateway strategy to expose legacy systems securely through modern fintech API integration.

RTB implemented a strategic fintech API transformation:

- Deployed IBM API Connect as a central API management platform.

- Created RESTful APIs interfaces for core banking systems.

- Integrated Plaid for open banking account aggregation capabilities.

- Implemented Stripe for modern payment processing APIs.

- Added Alpaca for retail investment API capabilities.

- Established comprehensive fintech API security protocols.

Results:

- Reduced new product launch time from 18 months to 8 weeks through API-first development.

- Increased mobile banking adoption by 137% via banking APIs.

- Decreased development costs by 41% using fintech API platforms .

- Enhanced customer satisfaction scores by 28 points

- Established new revenue streams through Banking-as-a-Service (BaaS) offerings.

Key Learnings:

- Start with high-impact customer journeys for quick fintech API wins

- Implement robust API security practices from day one

- Create a center of excellence for fintech API development

- Invest in developer education and API documentation

- Establish clear performance metrics for fintech API success

Regulatory Considerations for Fintech API Integration

Financial API implementations must navigate complex regulatory environments that vary significantly by region significantly by region, making compliance a critical aspect of fintech API integration.

| Regulatory Framework | Region | Key Requirements | API Impact |

|---|---|---|---|

| PSD2 | Europe | Strong customer authentication, third-party access | Authentication flows, consent management |

| GDPR | Europe | Data processing, storage, consumer rights | Data minimization, retention policies |

| Open Banking | UK/Australia | Standardized API specifications | Technical standards compliance |

| FedRAMP | US | Security standards for cloud services | Infrastructure requirements |

| CCPA/CPRA | California | Consumer rights regarding data | Consent and data management |

| NYDFS | New York | Cybersecurity requirements | Security controls, reporting |

According to Deloitte's Regulatory Outlook 2024, organizations face an average of 220 regulatory updates daily across global financial markets. This regulatory complexity makes API-driven approaches particularly valuable, as they can encapsulate compliance requirements and adapt quickly to regulatory changes through fintech API platforms.

Compliance Challenges and Solutions

API-driven financial services face specific compliance challenges:

- Consent Management: Implementing granular, revocable consent for data access.

- Cross-Border Data Transfers: Navigating restrictions on personal data movement through fintech APIs.

- Audit Trails: Maintaining comprehensive logs for regulatory examination of financial API usage.

- Service Provider Oversight: Ensuring third-party fintech API providers meet compliance standards

- Regulatory Reporting: Generating accurate, timely reports across jurisdictions

Solutions increasingly incorporate "compliance-as-code" approaches, with automated policy enforcement through API gateways, programmatic consent management, and integrated regulatory reporting capabilities for finance software.

Emerging Trends in Fintech APIs for 2025 and Beyond

AI and Machine Learning Enhanced Financial APIs

Artificial intelligence is transforming financial APIs from passive data conduits to active decision support systems. According to the FinTech AI Adoption Survey 2024, 73% of financial institutions now leverage AI-enhanced fintech APIs for risk assessment, fraud detection, and personalization in their finance software.

Key AI development in fintech APIs.

- Predictive fraud detection with 97%+ accuracy through payment APIs.

- Real-time credit decisioning in under 3 seconds via banking APIs.

- Hyper-personalized product recommendations using financial APIs .

- Automated document processing and data extraction KYC APIs .

- Customer behavior modeling and anomaly detection.

- AI powered API optimization and performance monitoring.

Embedded Finance and Banking-as-a-Service (BaaS)

The embedded finance revolution continues to accelerate, with non-financial brands integrating financial services directly into their customer journeys through fintech APIs. McKinsey's Embedded Finance Report projects the market will reach $7 trillion by 2026, representing 10% of all US financial transactions.

Leading embedded fiance innovations.

- Single API access to comprehensive banking infrastructure

- Embedded insurance at the point of purchase via fintech API integrations.

- Integrated investment capabilities within lifestyle apps using investment APIs.

- Buy now, pay later (BNPL) seamlessly integrated into e-commerce through payment APIs.

- Identity verification as a service across platforms via KYC APIs.

- Banking-as-a-services platforms powering finance software innovation.

Real-time Payment and Cross-border Optimization

Instant payment capabilities are becoming table stakes rather than differentiators in finance software. The Federal Reserve's FedNow service and similar global initiatives have accelerated the shift toward real-time settlement through payment APIs.

Emerging real-time payment capabilities.

- API-accessible real-time payment rails for instant transactions.

- Cross-border instant settlements via fintech APIs.

- Request-to-pay functionality banking APIs.

- Variable settlement timing options in payment processing APIs.

- Programmable payment splitting and routing.

- Real-time API monitoring and transaction tracking.

Decentralized Finance (DeFi) and Sustainable Finance APIs

DeFi (Decentralized Finance) protocols have matured significantly, with blockchain APIs now providing access to sophisticated financial primitives built on blockchain infrastructure. Simultaneously, ESG considerations have moved from niche to mainstream, with specialized fintech APIs providing critical data and analytics.

Notable developments include:

- Unified APIs accessing multiple DeFi protocols for finance software.

- ESG scoring and analytics for investment decisions via financial APIs.

- Carbon footprint calculation for financial products through specialized APIs.

- Impact measurement and reporting frameworks.

- Regulatory compliance automation for ESG disclosures.

- Blockchain API integration for transparent sustainability tracking.

Your Next Big Step in Fintech API

If you are looking to integrate fintech APIs into your application

Conclusion

The fintech API landscape offers unprecedented opportunities for innovation and competitive advantage in finance software development. Organizations that strategically implement these powerful tools are seeing dramatic improvements in development speed, customer experience, and operational efficiency through API-first approaches.

The future belongs to organizations that strategically implement fintech APIs defining clear objectives, selecting the right partners banking API and payment API partners, and optimizing continuously. As AI, embedded finance, and decentralized technologies mature, those who master API integration will gain significant competitive advantages through operational efficiency and accelerated innovation in an increasingly digital landscape finance software landscape.

Our expert consultants will analyze your specific needs and provide a customized roadmap for implementing the right fintech APIs for your business.

FAQs

What is Fintech API?

A Fintech API (Application Programming Interface) allows financial applications to connect with other software or databases securely. It enables tasks like payment processing, retrieving banking information, or checking customer identities through identity verification APIs efficiently and securely in finance software.

How do APIs improve customer experience in finance apps?

Fintech APIs allow finance apps to offer real-time data, such as current balances and transaction history through banking APIs, which helps users stay updated. Payment APIs also support smooth navigation and personalization features, making finance software more user-friendly and responsive.

Are APIs secure for financial applications?

Yes, most fintech APIs follow strict security standards and compliance requirements, including encryption, multi-factor authentication, and API security protocols to protect sensitive information and prevent unauthorized access in finance software applications.

Why are APIs important for finance companies?

Fintech APIs help finance companies automate tasks, process transactions quickly through payment processing APIs, improve data analysis via financial data APIs, and stay flexible with market demands. This helps companies operate more efficiently and deliver better services to their customers through API-driven innovation.

What are the best fintech APIs for developers?

The best fintech APIs for developers include Stripe for payment processing, Plaid for banking data aggregation, Alpaca for investment trading, and Onfido for identity verification. The choice depends on your specific finance software requirements and API integration needs.